The sp500 so far early today is in strong bounce mode. Yesterdays high closing ARMS reading apparently was the clue that we were overdue for an oversold type bounce.

So now the question… is today the bottom? or is it just an oversold dead cat bounce to be followed by another big drop into the weekend or right after the weekend ?

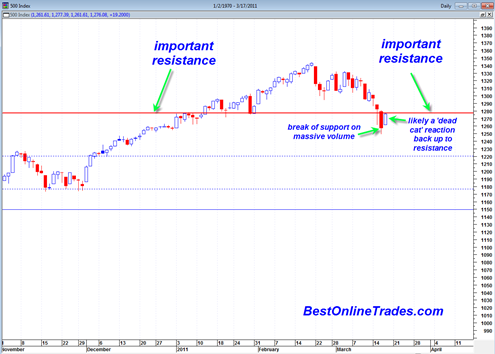

My current take is that today’s upside bounce is a dead cat bounce and we will see a bearish resolution eventually, possibly as soon as tomorrow or Monday of next week.

We already broke a key support level on massive volume and today we are rallying right back up to this now transferred level (transferred into new resistance). I suspect that the volume today on the SPY will come far short of the 400 million plus volume we saw on yesterday’s decline.

I would like to see the sp500 stay under 1277 to 1278 today as confirmation that today is only a 1 day dead cat bounce. From a bearish perspective it would be even better to see a sell off today near the close or at least to see the market give up half of its gains today…

If today does hold under 1278, then to me it still leaves the door possibly open for 1220 or 1180 perhaps next week sometime.

Now, if we somehow manage to bust above 1278 today or tomorrow, then I would probably have to rethink some of the conclusions I am making in this post. But as long as we hold under 1278, then I am in the camp that today was a dead cat bounce.

At mid morning and looking at the tape. This bounce really seems to lack confidence.

It is like a poker player, who already has a lot of money in the pot, saying I’ll call. And thinking if the other guys come in strong I am folding.

I think the bears have the better hand this time!

Friday morning…futures are up appearing to put us right on or about support. Wait at open to see if that bottom bollies curls or stays straight.