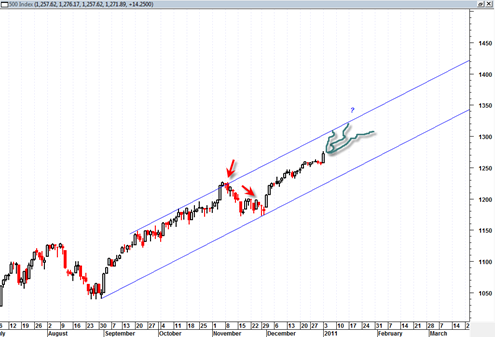

The sp500 today showed a strong performance and was able to hold a good portion of the day’s gains. Today’s move higher in the sp500 and the Dow Transports seems to vindicate the idea that the previous multi week sideways trading was simply a consolidation that served to work off over bought levels.

The Dow Transports blasted higher today right off of the important up trendline in force since early September 2010 and after this multi week consolidation. This has to be viewed as constructive for the bullish case.

The RSI is well into overbought territory or the ‘power zone’ and a retracement is likely to happen sometime this week, possibly as early as tomorrow.

The summation index forged ahead strongly again today and the RSI of the summation index zoomed past the 50 percentile line.

I am having a hard time coming up with a bearish scenario and any new short signal. It is possible the market could do a complete reversal tomorrow or by mid week and then reverse back down under today’s low. That would set up a more bearish scenario.

But for now the presumption may have to be that we continue to trickle up. I just don’t have any clear sign the market wants to turn yet. With the RSI above the 70 range level the market could continue to trend higher with corrections in the RSI back down to the 70 line which is what happen in the April 2010 time frame.

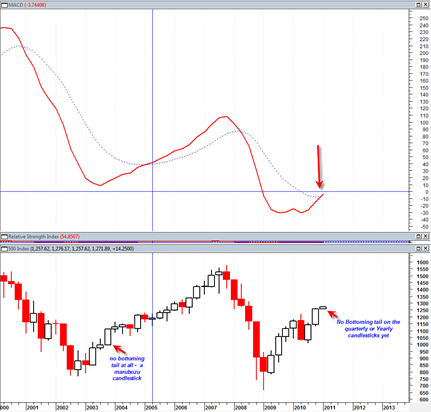

Notable as of today’s close in the market the quarterly candlestick price chart of the sp500 is showing that we have a bullish MACD crossover on the quarterly time frame which is a very long term bull or bear market time frame. The last time a bullish cross occurred was in 2005 and led to almost 2 years or higher price action.

We currently do not have any candlestick bottoming tail created on either the daily, weekly, monthly, quarterly or yearly candlestick price charts. I am going to be quite shocked if we do not even create a 1% to 5% downward bottoming tail on any of the above mentioned time frames.

A bottoming tail does not necessarily have to be created in the very early part of the year, but I think the sooner a bottoming tail is created the more bullish potential exists for a strong yearly close.

One has to be open minded to the possibility that the market may coast higher into a good portion of January 2011 until any real retracement can start occurring.

The key would be the weekly close this week. If the market can hold its weekly gains that would likely be the case. But if we get a strong reversal tomorrow and then retrace all of today’s gains by end of week, it could set the stage for an earlier retracement.

1300 to 1320 on the sp500 comes close to the top channel resistance line. If somehow the sp500 can muster enough energy to get that far this week it would put in a very strong potential reversal time frame.