The sp500 might surprise to the upside again next week and one very big part of the reason may be end of quarter and end of month window dressing. There are four trading days left in the month next week and four trading days left in the quarter next week. If the past is any guide, these last four days could have an upward bias to finish the week.

The sp500 on 3/25/2011 managed to bust back above the mini bear down trend line and was also able to trade a full price bar (both high and low) above this down trend line. It was not a big sign of strength to end the week but it still managed to break above the near term down trend.

Right now I would describe the price action as being in a ‘neutral zone’ (the yellow shaded area below) that is neither very bullish or very bearish. It is still constrained within a zone of previous resistance. The next most important challenge level is 1332. There is likely to be some selling from that level assuming we can get up there next week. If we do get to that point then I would look for selling to be contained within the yellow neutral zone to keep the most bullish chances for the market.

Getting into the green shaded area would be a pretty good sign the market wants to trade to new 52 week highs again in my opinion.

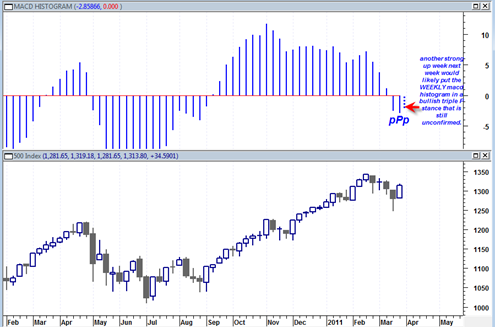

The other issue is the weekly sp500 chart. If next week manages to be another strong up week, then it will put the weekly MACD histogram into a bullish triple P formation that would have the option of being confirmed bullish the following week.

So on a weekly basis that is how I am framing the current market.

So an up week next week would leave the door open for a confirmation the week after that (first week of April 2011), and it would require a close above the high of next week.

So there are a lot of “Ifs” in this posting because we do not know exactly how the market will evolve the next couple weeks. But I am suggesting that if this end of quarter window dressing plays out as it usually does, then we may have a potential bullish triple P weekly MACD histogram buy signal in the making…