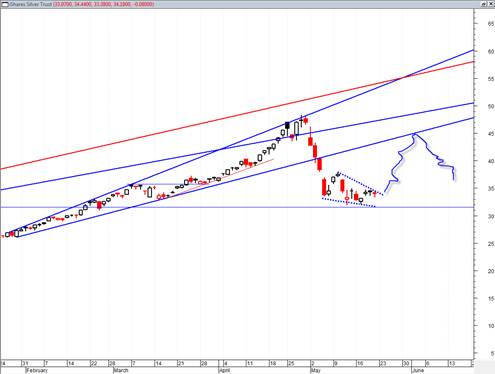

The SLV ETF looks to me like it is evolving into a great buy zone right now after the previous mini crash. I indicated several times in the past that the 5/5/2011 climax low would be difficult to exceed given its blow out volume and also that the swing low of 33.58 would not be exceeded or only marginally exceeded. Currently this appears to be exactly the case.

I think the SLV is a good buy in the current zone and I think it could move into a topside move that creates a trading range.

I would definitely be wrong if we break under 33 again significantly and close under there for several sessions.

It always amazes me how many are so quick to talk off the ‘silver crash’ and the end of silver and that the run is over after high volatility moves as we have seen. The hysteria over new margin requirements and all the panic associated with that will eventually burn off. This is not the end of the silver bull in my opinion.

The gold price also looks like it is about to reset for another run higher and may have a chance at 1700 by years end or sooner into the seasonally strong time frame of September.

Please explain why SLV would break out of the resistance, and not simply come down after bouncing from it. I understand the blowout, but then it is still in a box, and natural inclination is to bounce against resistance.

Looking at weeklies, I see a declining bear volume – very pronounced and obvious. Stochastics are going to oversold, and MACD is down, soon could be turning up.

So I agree with the outcome, just confused about the analysis.

SLV has an in spirit of bear flag, so further downside is expected. I wouldn’t touch this until it went down to daily 200 moving average of around 28-28.5 level. By then the 50 weekly moving average will probably get to that 28 dollar level, providing a ton of support on both daily and weekly chart. That would be a good entry point.

I just think we are at the turning point of the recent mini crash and will swing back up topside based on previous volume exhaustion and shift in momentum.

I feel the sentiment is turning and we are ready for that reversal. Dont think it is going to wait till June.

We’ve had the head and shoulders pattern on the SPX and today the cards are definitely on the table for a real red day.

Almost everything tells me the market should go down. But I think we are being set up for a big short squeeze by the FED.

Could be Ed… but I wonder if most of the short juice is already squeezed out of the market…

Today was just an inside day and a little pause.. Looks like a cascading waterfall decline coming soon to a theater near you..

Looking for some big down days soon so we can get to the Mid March 2011 swing low retest… that was a high volume magnet…

SLV: I am working off of weekly charts (per Alex Elder). MACD is way down, but has not turned up yet. Will wait up an uptrend in MACD on weeklies, and then wait for oversold or some down on daily before buying into SLV.

When looking at DIA on weeklies/MACD, we can clearly see a divergence between MACD lower highs and DIA’s higher highs. These things continue going for a while, but eventually technicals catch up with them, as they are catching up with DIA.

I am pretty sure SLV is going to be quite a complicated price action for several months with a somewhat large trading range… I suppose eventually the best buy will be when we get a new cross above 50, but until that occurs it is probably a swing trading range type market for a while.. with a good daily buy as of a few price bars ago..