I think the 500 billion plus economic stimulus package that the Chinese implemented is working, not just working but working really well. Just take a look at the Shanghai composite Index. The rebound recovery rally in the Shanghai composite started about 4 or 5 months earlier than the USA’s recovery rally as measured by the SP500.

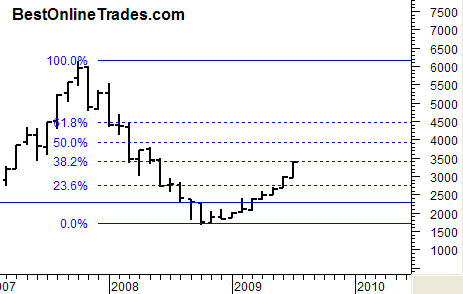

So far the Shanghai Composite is up about 104% from the intra month lows in late 2008. Wow. That is pretty amazing how far this index has come and how fast. It has me thinking that if this index continues powering higher up and through the 38.2 fibonacci retracement level there is probably going to be a mad panic rush to China stocks. Of course there already has been plenty of activity in Chinese stocks, but it could go into overdrive with the cooperation of this index.

I gotta tell you, I would not even been too surprised to see the Shanghai compositie index fly all the way back to the full 100% retracement level near 6000 before calming down. That is just the nature of the beast or should I say the nature of the times we are living in. The worldwide concerted effort to inflate our way out of the recession or pseudo depression is in full force. And with that kind of pumping you can see really WILD swings in world markets.

What the Shanghai composite is doing right now or what it eventually wants to do going into end of this year and early 2010 may be very similar to what the US Market did during the mid 1970’s. The mid 1970’s saw us hit that devastating bear market low in 1974 only to see a huge upward rebound that almost took the Dow back up to its all time highs again. So if that can happen in the Dow of the mid 1970’s, I do not see why it can’t happen in China here in 2009-2010.