The other day I talked about how REE Rare Element Resources Ltd was a unique type of stock because of the huge surge in volume relative to its previous average volume.

I also mentioned that the stock would likely be a good buy setup if it can find a way to get down to the 4 dollar range.

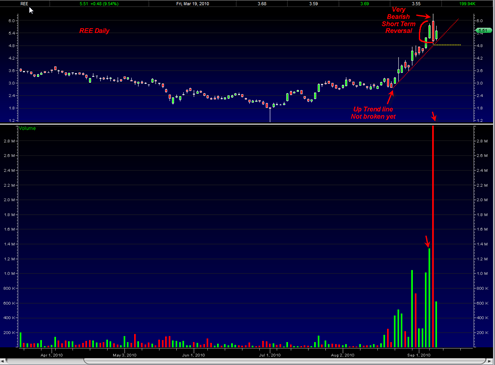

I am looking at the stock today and it seems blatantly obvious that this stock is about to reverse down very hard. Yesterday there was a very bearish looking bearish engulfing candlestick that fully engulfed the previous days candle by a mile. In addition the volume yesterday on the engulfing was more than double the previous day.

This bearish candlestick setup would not be confirmed unless a close below 4.85.

I just started reading the book Reminisces of a Stock Operator by Edwin Lefver that talks about the trading of famed 1920s trader Jesse Livermore. The first part of the book goes into many stories of the manipulation and coordinated efforts of the ‘bucket shops’ against the average traders. During that more loosely regulated era, large groups used to mark up stocks in coordinated effort and then unload the stock to the unsuspecting public. The descriptions of detailed tape reading is quite fascinating.

So when I look at REE, a low float stock, I cannot help but think that this stock is in the hands of the few and easily manipulated. But the fascinating aspect of the chart in the current picture is that the candlestick pattern and the volume seems to suggest that the early crowd unloaded heavily yesterday which likely changed the character of the uptrend.

It is going to be interesting to see if REE falls back to earth in the next few days. I think this stock is a great example of tape reading as a clue to the inner workings of supply and demand (and maybe manipulation too).