I have been studying the stock price charts of the period 1987 and the current time frame on the S&P500 the last couple of days and also 1929 and I cannot help but think we have the potential for some sort of repeat this week. For a while now I have been running with the theory that this correction will be similar to the 1975 correction and be somewhat mild and orderly perhaps on the order of 15%.

The problem is that the price action that has developed over the last few months on most major indices resembles that of a broadening top pattern which has the potential for very bearish downside resolutions that can resemble near vertical price action. It is important to note that the tops in 1929 and the top in 1987 were also broadening top patterns.

I feel as though the stock price action over the course of the next few months is perhaps the most important price action I will witness in my entire life. I say this because the nature of the price action is going to determine with a good degree of certainty whether we are in a long term 1929 ‘total meltdown’ scenario where we continue to decline with relative persistence into the 2011 2012 time frame, OR whether we are in a reflationary mid 1975 scenario where we work on the correction for several months, find support and buyers and then eventually get another big rally going that lasts a year or more.

Is the Stock Market Going to Crash This Week?

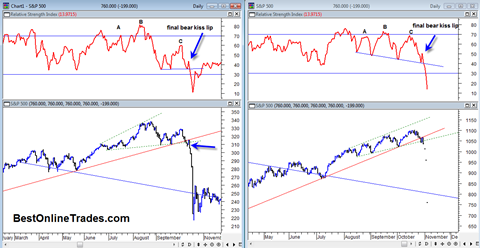

I have drawn up a chart similarity between 1987 and the present time frame at the bottom of this post. I was able to extrapolate possible future price action based on RSI values. I really do not want to see a stock market crash this week. It would not be a good thing for the world or anyone’s well being unless they are positioned for it. It would be a sad day for many people and quite a helpless feeling to be quite honest. I can only hope that people try to protect themselves and manage risk prudently so that they come out ok in the end.

Predicting a stock market crash is not a high probability business. It is an extremely rare event and in most cases will not happen.

However we do need to understand that despite the powerful rally we have had since the March 2009 lows, we are still in a very severe and dangerous long term bear market. The bear market decline that took us into the March lows was marked by very persistent price action and price action in certain companies (investment banks such as Lehman Brothers for example) almost overnight went from high double digits to low single digits in an eye blink.

Also I believe it is not that uncommon to see 100% retracements of big rallies in major bear markets. So we hit the low in March 2009, but it would not be out of the ordinary in this type of bear market to see a 100% retracement of the entire rally that has occurred since then. I have seen that type of price action in many individual stocks as they have hit bear market lows and then rallied off those lows, only to retrace 100% of the gains a bit later. In addition this type of 100% retracement would also be consistent with the price correction that occurs AFTER a strong ‘automatic rally’ which is what I believe occurred from the March 2009 lows to present.

Another aspect that I think is important to be aware of is that fund managers do not get fired for showing negative returns in a down market, but they do get fired for showing negative returns in a huge up market such as the one which we have had since the March 2009 lows. So that type of mentality is one which could potentially spark very quick panic selling as they unload shares to lock in gains.

A couple other minor points I want to make which I noticed in the last week is that I have been seeing an unusual number of bad ticks in my real time charts. I typically only see that many bad ticks on highly volatile and emotional penny stocks, but recently I have been seeing it in quite a few ETFS and the major averages as well. There was a brief article in the New York Times on Friday that talked about some errors generated on the NYSE Friday but it was only brief. Strangely enough that reminds me of all that talk in 1987 of ‘computer problems’.

The other problem with the rally from the March lows is the argument that it has been ‘artificial’ since it was essentially government manipulation to pump up the economy and the market. The size of the market is much larger than any one individual force. Manipulating and pumping up the market may work for a short period of time, but eventually the market is too powerful and will eventually return to the mean level where it was before the manipulation. In some cases this return to the mean can occur very fast.

Also. Volume. The volume on Friday was very heavy on the SPY ETF, one of the heaviest selling days I can remember and relative to any of the previous up volume days was huge. Once again not a good sign at all not too far from the market highs.

Ok now onto the chart. The chart comparison between 1987 is quite compelling. The MOST compelling part of the comparison is how price in both 1987 and 2009 broke under the key supporting uptrendline and then rallied back up to the underside of the trendline and then the NEXT day closed down very hard near the lows. By the way, this type of price structure setup is also very similar to what occurred on 9/29/08 to 10/3/2008 right before the worst part of the multi day plunge in October 2008.

If you look carefully at the RSI (Relative Strength Index 14 day) you can see the similar head and shoulder formation labeled A B and C. In addition I point an arrow indicating the possible final ‘bear kiss’ in the RSI right before the massive plunge.

In the current time frame I extrapolated the percent moves in 1987 to the current time frame and they show as 3 dots in the right portion of the chart on the SP500. So if the current market is to decline this week each day of equal price magnitude as that which occurred in 1987, then it would plunge the RSI to about the 14 level and put the price on the SP500 near the 760 level and near the solid blue line channel support. This blue extension line was similar support in the 1987 period. In 1987 the RSI hit a low of about 11.5 . The SP500 moving to an RSI level of 14 would definitely be a black swan type of occurrence, just as it hitting 11.5 was a black swan type occurrence. It would be in deep oversold territory after having already been in an oversold condition. It is also important to note that on the long term MONTHLY Price bar chart the market has already shown itself an ability to hit record RSI oversold readings. These record low readings where achieved during the March 2009 time frame on the monthly scale. My point in bringing this up is that we have a market here that seems fully capable of ‘pushing the envelope’ in terms of extreme downside price action.

In my opinion if the scenario is to play out exactly or very similar to the 1987 period then what we really need to see is hard down price action almost every single day this week that plunges the RSI level to deep oversold. A final low could occur either this Thursday, Friday or Monday November 9th which is a bradley model turning point date.

If Monday, Tuesday or Wednesday is a strong up day then something different may be going on and the whole nature of the decline may be entirely different and perhaps much less severe.

I have to admit it seems almost unthinkable to consider that the SP500 could be at 760 by the end of this week or next week. The window of a panic happening is quite short and to keep it working price has to follow the path in short order in my opinion.

I should add that one other element that could play into the price action this week is the astro stuff per Larry Pesavento. Larry Pesavento has indicated that there is the ‘combust’ planetary aspect on November the 6th of this week. I find it noteworthy also that we have an official full moon on this Monday November the 2nd. I am no astro expert when it comes to the markets, but could it possibly be that the full moon will pull the market right down into the combust aspect by end of week?

So the market has a choice to make this week. A choice about which correction scenario it wants to take. The scenario I have covered here happens to be the most severe one. But there are plenty of other scenarios (much milder) as well which I may highlight as the week rolls on…