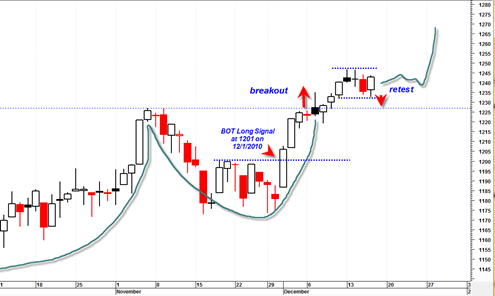

There is still no short signal according to my work. We appear to be in a sideways market that is simply consolidating the upwards burst in price action that occurred in early December 2010. This upwards burst in price action represented the completion of the handle portion of the much larger cup and handle formation in my opinion. Since breaking above the handle, the market is trying to figure out if it should sell off or go higher. I suspect that sellers are being absorbed by new buyers but the buying conviction is lacking enough steam to push the market higher. Still, I do not see any clear signs of weakness in the tape despite the appearance of lackluster action.

I mentioned in yesterday’s post about how we need to close under 1227 to inject some more bearishness into the market and the bears could not even come close to doing that today. This fact combined with the current sideways nature of the market tells me we are in no mood for any big sell off going into the last two weeks of the year.

The NYSE summation index is drifting around and seems to be suggesting that we could keep chopping around sideways for a bit longer and then likely maintain a bias higher.

I was temped today to initiate a BOT short signal. I was tempted yesterday as well, but I was able to resist that temptation and simply wait for some signal near the 1227 level which the bears cannot seem to manage to attack.

So its just another day at the office of the sp500… The trickle up continues…

If the algorithm boys in China want to make a bear raid on the market, Monday would be the perfect day.

The NY players will all be off celebrating Christmas, a holiday that is considered somewhat strange in China.

While the cat is away the mice will play.

If they hit it hard, then we may see a great opportunity for the short side.

Anyway, I am keeping my powder dry!

This market has thrown me for a loop. Hard for me to trade it. Your analysis is spot-on.

yea guys it sure is a strange looking tape that is defying gravity and simply hanging sideways… The bulls just don’t want to let go. They may just close this market only a few tenths of a percent from the yearly high by the end of this year. And then a pullback in first week or two of January.

Maybe BOT short is appropriate right on the first or second trading day of the year to create some price retracement into the 2010 YEARLY candlestick… maybe this will be the plan for the next BOT Short signal unless something changes dramatically in the next two weeks.