There was a huge huge trade that I missed today unfortunately and also was not quick enough to write about it. The trade was going long the EWJ (Japanese Nikkei ETF) right near the open today.

The EWJ opened down in crash fashion because of the overnight drop in Nikkei Futures. The opening in the EWJ ETF was so extreme that it had the daily RSI at a record record low point perhaps near a value of 10 RSI, not only that but the EWJ also opened right at a strong level of support from the June July 2010 time frame. This morning was a huge opportunity to go either long the EWJ or long some March or April call options on the EWJ for potential 100% to 500% profits by the end of day.

Certainly based on the news it would have appeared that the EWJ was an extremely high risk trade with the nuclear and earthquake fears, but in actuality this is one of the lowest risk trades one can take in my opinion.

You had washout blow out panic volume, massive oversold RSI and opening right near an important support range.

I think it is quite fair to describe the recent 5 day move in the Japanese Nikkei index a crash in terms of the speed and magnitude of the decline.

So the lowest risk trade was near the open today, but there may still be a chance to trade the EWJ as it is now still in a very high volatility cycle and we should see huge swings in both directions. But I would say that now the trade becomes much more dangerous compared to this morning’s trade.

The crashes that I have experience and watched over the years seem to generally have the same pattern. First you get the initial massive panic day on massive capitulation volume. Then you get a strong automatic rally up, and then this rally stalls out. After the automatic rally stalls out, there is typically a RETEST of the CRASH LOW on lower volume to mark the final low.

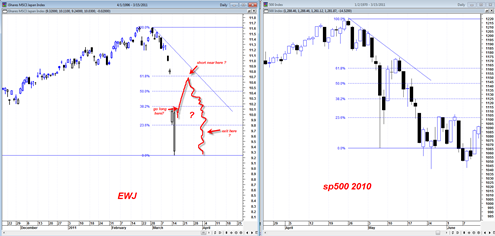

What is interesting is that the current decline in the EWJ seems to map the flash crash low of May 6, 2010 in the sp500.

We should now see perhaps a massive upwards rally in the EWJ ( the 60 minute chart is showing a potential head and shoulders bottoming pattern with a projection of about 10.62 in the days ahead) that eventually loses energy and then starts a follow on waterfall decline back close the panic low of today which was 9.24.

The Fibonacci 61.8% retracement of the decline comes in at 10.70, so somewhat near the 10.62 inverse head and shoulders projection.

The sp500 on its automatic rally managed to make it to the 61.8% retracement as well. Whether the EWJ can make it that far is unknown but it is a potential target area. Also to consider is the down trend line that started the decline. The sp500 almost made it all the way back up to this line.

One thing I know for sure is that the low today in the EWJ will eventually be retested. It was on absolute blow out all time record high panic volume. It WILL eventually be retested.

So the very aggressive trading situation is to go long the EWJ on a move above 10.12 then let it try to find upside near the 61.8 Fibonacci level or near the down trend line and then go short for the very likely eventual retest of the blow out volume low similar to what occurred in the sp500.

But again, the trade was at the open today. Now it gets much more complicated with more difficult violent up and down swings in this range…

I am going to keep track of this EWJ the next 2 weeks and see what can be learned here… More post updates on EWJ as developments warrant…

I love Ulyssis. Being an older guy, it is really relevant and I use it all the time!

On to the Market.

I think we will see more downside action tomorrow. Sorry Tom.

An EW count here looks like a P[3]. The bounce back today creates a wave overlap of yesterday’s low and shows a first subwave(ii) of (iii) rather than a wave four. So to me we are not looking at a 3rd of a 3rd since we pulled back from the morning’s low. I like this, since according to EW we should be looking at a deeper sell off to come.

At this point all the major indexes have broken their support levels. So that should be the resistance area if and when we have a bounce.

Ergo, this market still has to work out its downside move. I am thinking we are going to see the downside resolve with a BANG rather with today’s whimper.

certainly that is possible as well, sometimes the restest of the high volume low comes first, and then the bounce… but I still think given the high volume of today that it will serve as a stoppage point for any retest… I don’t see us slicing below todays low very quickly any time soon.. but we will just have to see how things shake out the next few days..

Either way the Friday before the upcoming weekend of the Monday after this weekend are very potential key turn dates. So if we do rally higher in an automatic rally as I think we will then I expect us to top out in the next 3 or 4 trading days. On the other hand if we continue to break down as you predict, then I would look for a very important low in 3 or 4 trading days from now..

thanks for your comment..

Funny coincidence that I bought several hundred shares of EWJ in the after market today at $10.02. Just decided to hedge some of the SPY puts that I had leftover from todays action. (Sold my Puts off the the SPX 60 minute triangle with a measured move to 1255-60 but bought some back.) Looked oversold to me too. Currently the Nikkei is up over 3% so if it stays up for the rest of the session and we don’t gap down tomorrow, I’ll probably try to sell them in the same vicinity as mentioned above. If it were not for the Earthquake/Radiation problem EWJ may have been a good long term hold. Totally news driven market now, for better or worse.

nice call on market resolving with a BANG instead of whimper JR, seems to be happening as you have stated..

I bought EWV yesterday afternoon, for what I thought was a ridiculously low price. Last night I watched the Nikkei rally, but they just couldn’t get all the way back up as the EWV people had been betting. It was sickening, watching the numbers and thinking of the poor Japanese with no food/water/heat/etc. Today I sold half.

Bear investing is hard! Thanks, Tom, or your careful and underhyped analysis of the recent SPY trend, which helped me to realize that bear was the direction I should be going in.

You are very welcome.. but be careful now as the next move may be ‘scorched earth’ …. coming into a key juncture soon…