ABK Ambac Financial also came up in my new scan that I developed yesterday and also showed up in the MarketClub Scan. As I just indicated in my previous post, the real estate sector is starting to rise from the dead a little bit and so this sector may be worth paying attention to.

I was lucky enough to play ABK Ambac Financial way back in August of 2008 after it had a massive bear market rally from a dollar and change to almost 10 dollars. I remember it vividly because I was on vacation in Cape Cod up at the Eastham cottages and I remember trying to manage this trade with my laptop using the hotels wireless connection they had in the lobby. I would go there every morning and then in the afternoons trying to engineer the Ambac trade. At the time it was consolidating in mid August (see chart full size by clicking on it above) in a somewhat ascending triangle or symmetrical triangle pattern. But I was stopped out several times and then had to re enter for the eventual move to 9 and change. I had to be real careful about getting into Ambac because the stock had already had a big move and I was not in the trade right off the bottom, so I was unsure whether it had enough steam to go higher.

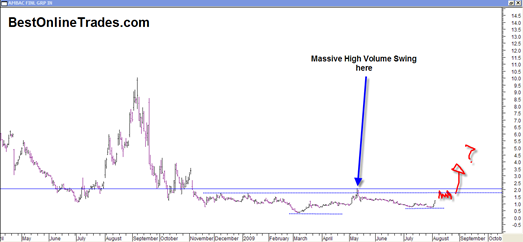

Anyway, here we are in 2009 and ABK has formed a higher low about 4 months apart and recently has had a big volume thrust upwards. Today it looks like it is up pre market to 1.50 already and so it will probably get some follow through from yesterday and spike higher.

But there is Still no Trade here yet!

The trade is not here yet in ABK in my opinion despite the frothy action yesterday and probably today. But the trade is developing possible in the weeks ahead. I see ABK hitting top line resistance between 1.5 and 2 by the end of this week and into next week. There is a very high volume swing at that level (see chart) and I expect that to be very difficult to get through. ABK will NOT in my opinion be able to slice through that easily. There is going to have to be some sort of sideways consolidation either in the form of a symmetrical triangle or simple sideways basing range. Perhaps that will last 1 or 2 weeks. The parameters of that consolidation is where the possible trade can develop, but NOT NOW.

So like a cheetah in the desert the prudent strategy with ABK is to sit and wait for the trade to develop like fine wine. ABK is a good trading vehicle because what you have is a former blue chip type stock with a lot of trading liquidity, a nice cheap price and a long price history to plot and analyze.

So that is my heads up on ABK for now. I am going to revisit this in a week or two.