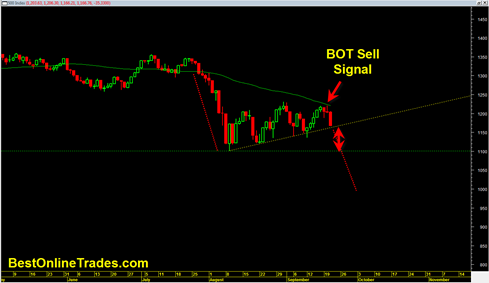

Today’s action was the clincher. The charts up until 2:15pm today were lined up for a big drop and that is exactly what happened irrespective of the Fed nonsense. I understand trader’s fear of the Fed and not to fight the Fed, but the charts today were so nicely lined up for a drop, and I am pleased with their predictive power today.

Based on today’s action makes me now extremely bearish this market for the next 10 to 12 trading days or so leading up to October 2011 earnings season. My sense is that we are going to absolutely plunge down into the beginning of the next earnings season and then once we bottom out you will see similar whipsaw action like we saw over the the last Month and 10 trading days. The whipsaw action will likely occur in October as you see both good and bad earnings and outlooks from corporate America. It will be extremely difficult to trade during that time.

So my take is that the real meat of the short action will occur over the next 10 to 12 trading days. Essentially I think we are looking at a ‘buy and hold’ short situation from here until early October 2011.

Today’s action was absolutely wild but the next major major battle front is the August 9th, 2011 swing low which will be the ultimate battle for both sides. Breaking under that low should unleash some very heavy selling in my opinion. I suspect we should see some type of reversal or bounce from 1100 but it will probably be brief. I think all rallies should be shorted from here until end of September or early October 2011.

The market now has 1 MONTH and 8 days of sideways trading cause (or fuel) for the next move down. It has built sideways steam for a new move and that move looks down to me.

As far as the near term action to close this week, I would not be surprised to see a big opening gap and go down day tomorrow, and see a gap that remains unfilled. The much more conservative scenario is an inside consolidation day tomorrow and then a big dump on Friday. Tough call on the 2 day action, but the bottom line for me here is to sell any rally.

Sometimes the market serves up an easy pitch and this pitch looks quite attractive to me. The bulls dropped the ball big time and the bears took control of the tape. The market has spoken.

The only remaining doubt I have now about the decline is how we are going to deal with the August 9, 2011 low since it was such a huge blockbuster volume day. For us to blast through there with conviction means we will need a huge surge in volume. It suggests something quite ominous may be on deck between now and that swing low.