This market is bouncing up and down so much lately that I am starting wonder what is the longest time period that I will maintain a consistent market stance, either bullish or bearish. I have been talking bullish lately on the intermediate term time frames, but looking at the near term daily chart today has me thinking we could start to break down soon again from this rising wedge.

The fact still remains that the SPY has still not broken up above the key 6/21/2010 price swing and until and if that happens, there is no new bull trend up. That 6/21/2010 price swing is a very important guidepost. It correlates to important swings in other markets as well. For example in the XLF ETF it represents the top very significant resistance level that must be broken topside in order to sustain bullish momentum.

So here we are in low volume August and it seems to me that it will be very difficult to break above the recent important ranges I have been talking about lately. There simply is no volume this time of year. If we were in early September I might have a different opinion.

So basically my stance is that I am quite bullish the market IF the SPY can jump above 113.20 and hold above there. Anything under that represents still lingering bearish risk to me.

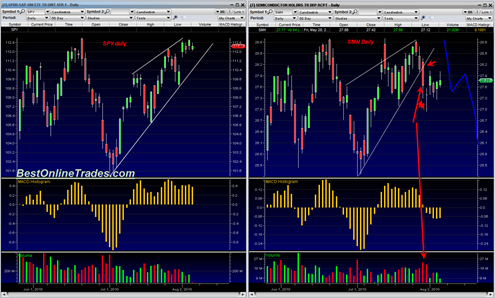

Speaking of lingering bearish risk. There is still risk of a break down from this large rising wedge formation. The very light volumes into the apex of the wedge are consistent with the wedge formation. Sometimes price declines out of rising wedges can be quite sudden and seemingly come out of nowhere.

I once again refer you to a previous post I did on the Semiconductor HOLDRs (ETF) pointing out that the SMH can sometimes be somewhat of a leading indicator as it may be more economically sensitive.

If you look at the SPY and SMH price chart side by side you can clearly see that the SMH has broken down through its uptrendline on very heavy relative volume. Since the break down, it has attempted to rally higher but only done so on very lousy volume. This leads me to believe it is doing an ‘A B C’ down move perhaps to the 26.4 range.

If this is true, then it would seem to make sense for the SPY to follow suit and get a break down through its recent supporting up trendline ( the line that defines the bottom of its rising wedge).

It is also worth mentioning that the recent rising wedge apex seems to match up nicely with this powerful August 10 to 12 cycle date. So it would seem like this could be a price high. Regardless of that cycle date, the SMH chart already seems to be revealing the big clue about the next direction for the SPY.

I have to say honestly that the break down in the SMH tips the odds in the bears favor for the next 5 trading days or so. But in the same breath I do have to repeat my stance that this market is very bullish above 113.20 on the SPY.

Tom

“here we go again” – – – not much to say.

in case you have not seen today’s Kitco site, 2 commentators have interesting view of S & P – – see commentaries of Summers and Vermuleun (5th – August)

Thanks for the heads up on Kitco Geoff. Looks like we go down from here from this massive wedge.

Hey Tom,

Both charts look like a perfect sign of the bear I mentioned earlier. I guess we’re gonna see one last spit to the upside on Monday on hopes Ben’s a magician but then sell off big time as he speaks.

You could be right Max. But in the back of my mind I still have this feeling the bulls are going to let this market run higher than many of us can imagine right now…