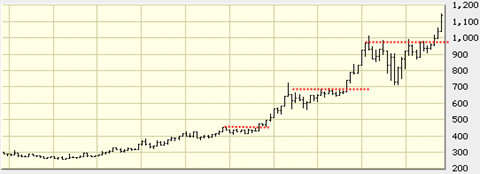

It appears that the gold price is setting up to move into a parabolic type advance now. There was a lot of sideways cause built up since the March 2008 beginning of pattern and now some of that cause is being used up but I suspect it is nowhere near being finished yet. I would expect at least another three months of upside price movement.

There may be some complex corrections of maybe half a month in duration during the advance, but overall I expect the trend to be persistently up. It would not make any sense at all for the gold market top top here at this point given the large amount of cause building that occurred since March of 2008. This is why I believe any top calling at this point is premature.

During the later stages of this type of advance it would seem gold fever can once again come into play causing massive speculation and bidding up of the most speculative stocks.

The 1 dollar and change mining stock I mentioned before TLR Timberline Resources continues to hold it’s 50 day moving average and the chart looks like it wants to get an upside breakout going quite soon.

I am also following a couple pinksheet penny stocks in the gold mining sector that could see massive speculative gains on this gold mania run. They are CVRG (converge global) and KATX (Kat Exploration). Both of them trade on the pinksheets and are just a few pennies a share. CVRG has quite a good chart structure and I would not be surprised to see it test the .445 swing high perhaps by March next year.

During the entire gold bull market there are going to be lots of opportunities to take advantage of the mass speculation stages of the bull run. They don’t happen all the time but when they do it is worth it in my opinion to ride along for a while with the speculative fever.

Seasonally, gold should be strong right into the end of this year and I would expect that strength to support the mining sector as well.