In other words it is not easy to get this market to decline more than 1 or 2%. Only a couple days after I issued a BOT Short signal the decline so far is a very meager one that is really slow on the tape. To get this market to decline more than 1 or 2% it seems the bears have to sell their soul or something similar.

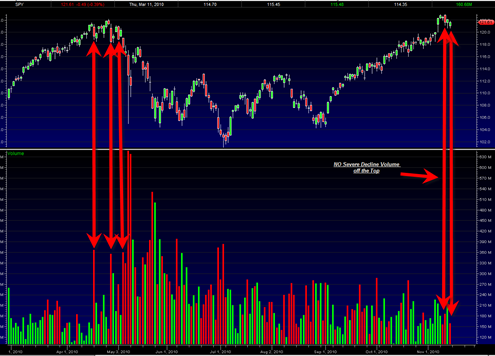

The most concerning aspect of today’s decline (from a bear perspective) is the very weak downside volume on either the SPY the DIA or the QQQQ. This contrasts very sharply to the April 2010 top in that the April 2010 top had a series of extremely high relative down volume days right near the top of the price range near the highs.

But this time around I am seeing a dramatic decline in sell volume on today’s gap down. Of course there is still time next week to start getting some of the high volume down days but so far the market has not obliged.

The other issue of concern for the bears here is that despite the last 4 day pullback, there is nothing abnormal that has happened so far when we look at the DIA chart and a few other indices as well. The DIA has basically done a classic Wyckoff Retest today on low volume. We broke under yesterday’s low and then closed back above it and this was done on 50% lighter volume. The volume shrinkage today on the retest is quite telling.

So the DJIA basically needs to hold 11,231 in the week ahead to maintain this Wyckoff retest structure and open the door for either more flat trading and then eventual new move higher.

Only a decisive move below 11,231 in the DJIA is going to get me much more bearish or a move below 1204.49 on the sp500. We just have to presume still that the market has enough strength to hold its ground here.

As far at the BOT Short Signal I might have to switch to a different signal again soon but I am in a bit of a stalemate as to what to do next. The volume picture, the classic Wyckoff retest picture and using price as a leading indicator seems to suggest that one should remain neutral here until we break out of the current trading range that started on 11/4/2010. But it seems foolish to switch to a new long signal tomorrow for the possibility of only a small handful of sp500 points to the upside. So I will keep the Short Signal for possibly another week on the premise that the market is working into some type of topping process here.

But on the other hand, we do have the daily MACD pretty close to bearish crossover mode on all the major indices. On the NYSE composite index I am seeing a bearish divergence between the recent price highs and MACD. An oscillator such as MACD is not a leading indicator however the bearish divergence gives it a little extra weight this time around. The Wyckoff retest and the volume picture I mentioned earlier is much more timely.

The summation index is meandering sideways as price pushes higher. I have no clear signal from the summation index. It did tick down today, but it needs much more work before it can be said it has charted a new momentum direction.

The US Dollar was again strong today and this seems to be the wild card that could get this market to take a hit. But we need to see the UUP ETF break above 22.70 very strongly as a sign that a ‘real’ dollar rally is kicking in and maybe gets the stock market to correct a bit more.

If we look at the blowout volume that silver had two days ago of 150 million shares on the SLV ETF, it sure does seem to support the case of a some type of consolidation process for the metals. But the super high volume reversal in silver two days ago did now show any follow through the last two days and we may go back up to test the high of 28.72 on the SLV. It will be extremely difficult to bust through that level however because of the HUGE climax volume up there.

So there are some mixed signals now with the possible bias to the long side. But the market is going to have to ignore a possible upside break out in the dollar index, ignore a possible intermediate term topping process in the metals, ignore the daily bearish crossover in the MACD and a bearish divergence in the MACD on the NYSE composite index.

We are almost into the middle of November 2010. If the market can somehow get more decline going into end of November it would set up quite a bearish looking monthly candlestick. But for now that is a big ‘IF’.

Friday Nov 12th Close:

The last time the TRIN/ ARMS Index had a single day reading > 2.00 was back on Sept 7th when it read 2.02. The 10 day moving average of TRIN, after close today, is a dead neutral 1.02. The TEN (10) day moving average corrections that we over the summer peaked at 2.53 on June 11 and 1.85 on August 24. Those peaks represented 10 day averages!

This market is not the least bit scared. Ben / POMO will bail them out.

The Aall Investor Sentiment Index read 57% Bullish on the reading closing Nov 10th (2 days ago) and the spread between Bullish and Bearish was twenty percentage points – – the same spread that it has been for 9 consecutive weeks now.

The “pug” elliott waver thinks we are in for a shallow correction. Maybe, we are. I have been very wrong. But I think this “correction” if it turns out to be that will be either deeper and quicker than we think or it will be very extended sideways move (which is probably the most realistic outcome) that drags on thru the end of the year. If there is any hint that Bush tax cuts will not be extended for all (which is the ONLY outcome the Republicans will accept) the market will correct sharply. There is a lot of business that the lame duck Congress has got to enact.

I am an old guy, and I only remember one time in my life when the market corrected sharply in November – – and unbelievably the correction kept going on and on and on until even the week of Thanksgiving! After Thksgiving it stabilized to the end of the year. I am pretty sure that was one year in the 1970s. So the chance of a meaningful correction at this time of year is remote to say the least – – 1 chance out of 40 maybe!

There is a lot of venom in Washington and a lot of venom aimed at the FED from offshore. IMHO, the FED should back off just printing money and require the US Government to raise funds on its own to pay for the deficit. This would be one SURE way for Congress to start getting serious.

OK, I know everyone loves it when I talk technical. So here it is. I put a lot of weight on the Wilshire 5000 since of all the indexes it is really the best picture of the total market.

Friday the Wilshire settled at the higher-low channel line 12674 almost exactly. That would indicate a bounce is near. But the real indicator is the RSI (Relative Strength). Friday it hit a very significant low that is 30.26. According to Wilder, the genius behind the RSI, an RSI that low indicates the market is significantly over sold.

Interestingly the last time the RSI hit that low was just before it took off in September from a low of about 10870 on the Wilshire to go to 12970 approximately. In other words a 2000 point move up.

Caveat: The Wilshire could go lower to hit the base channel line at 12508. Considering the RSI that is not very likely. I think the higher-low channel line is much stronger since the Wilshire has bounced up to higher highs off this line four times in the last two months!

Geoff: I think we are on the same track just saying it differently. Maybe!

This market could do a steeper correction even though seasonal patterns would suggest otherwise. Sept was a big seasonal down month but we blew through that. Expect the unexpected

i am “with you” Ed – – – if not a steep unexpected correction – – and IF market keeps relentlessly moving higher, sentiment indicators, already high, are going to the moon. the USA put men on the moon, so suppose that Ben / POMO could as well!

According to today’s Barron’s (Nov 15 issue), the latest Consensus Bullish Sentiment was 71%, up from 67% the week before. Sorry, I can not put that reading in context of last April, but i think it was almost identical back than (I have no proof – just my mental recall).