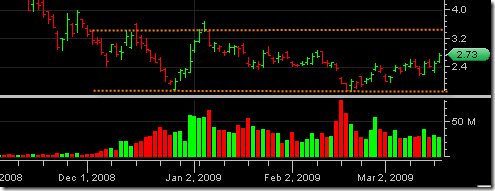

I am still long the DXO double long Crude Oil ETF right now we are trading at 2.72. My entry was 2.32 after earlier being stopped out from an earlier position. The overall structure of this ETF still looks good as I have already talked about before here. I still like the setup and like the fact that we are sitting on a huge long term support level in crude oil.

I am still long the DXO double long Crude Oil ETF right now we are trading at 2.72. My entry was 2.32 after earlier being stopped out from an earlier position. The overall structure of this ETF still looks good as I have already talked about before here. I still like the setup and like the fact that we are sitting on a huge long term support level in crude oil.

Come to think of it, that is probably one of the most favorable types of setups I like. When you have something come down to a very long term support line and then bounce around a bit before building up enough steam to try and move higher. It just makes a lot of sense from a risk reward point of view. Buying something in the first third, second third or last third of its mark up can still make you a profit, but in my experience there is always more potential downside risk for the simple reason that the longer something moves up, the more reasons there can be for people to want to take a profit.

The downside of trying to enter positions in any stock index or ETF after a long bear market decline is that there is a tremendous amount of volatility before a new uptrend can begin in earnest. For example you can have a 50% off of the bottom, only to retrace 100% of it so that more basing can be achieved. Now the volatility can be good of course if you are nimble enough to trade all the little swings, but can also cause a lot of churning in your account. So what I try to do is wait for that sign of preliminary demand, then let it retrace as long as it needs to and then look for a double or triple bottom before entering.

Anyway, I am looking for the DXO to hit 3.5 or the top of this trading range before the next consolidation. Crude Oil Inventories are coming out tomorrow morning at around 10am so perhaps this is a run up into the news? We shall see. But regardless of what happens tomorrow, the crude oil price still looks like it wants to build a foundation here for a natural retrace to somewhere near 70 eventually. I am only looking for 3.5 however as far as the DXO is concerned.