I have written about the Dow Jones Industrial Average before. I also made a gutsy prediction that the DJIA would hit 14,000 by February 25th, 2007 . I still stand by that forecast.

But first things first. Clearly in order for the DJIA to get that far, the first thing it has to do is break out to a new all time high. I believe this moment is rapidly approaching. In fact it may come sooner than we think. We may even see DJIA 12,000 by the end of April. I am expecting wide price volatility and ‘heated market action’ in the DJIA.

A new all time high for the DJIA is a big deal because it represents to a large degree the general publics indicator of the ‘market’. Plenty of other indices have hit new all time highs but the DJIA has lagged. Could the DJIA hitting new all time highs be the final piece of the puzzle that helps to accelrate the market going into 2007? It is possible. But I will take things a month at a time.

How to make money from the upcoming DJIA breakout?

The dow diamonds are a decent play here in my opinion. The 2007 115.75 DIA Call option seems reasonable here. It is currently priced at 5.00 .

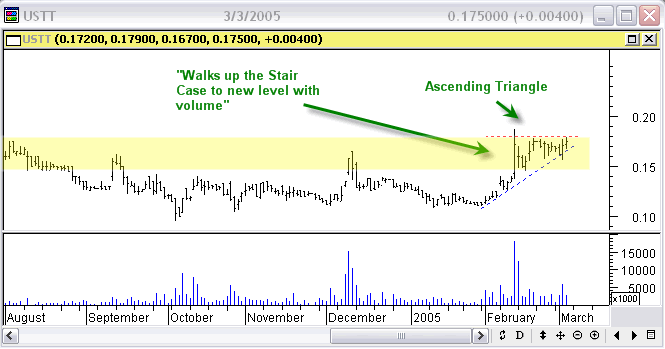

The price structure of the DJIA chart is telling me we will see an acceleration in price. That conclusion simply comes from experience and a close look at the price action.

In my previous post I talked about Coca Cola entering a new bull market. That should help the Dow a bit with its breakout and vice versa. The structure of the DJIA and my forecasted breakout is consistent with Coca Cola breaking out as well.

HEADS UP and WAKE UP!

Exciting market action is dead ahead!

I would like to see this entry updated given the events of the summer and the serious correction of the Dow and S&P we saw… Thx

my question is :

Is there anything to do with recession in U.S economy with the Dow Jones Industrial Stock option.

Will the recession lower the stock option? I have been following ur updates.. As said I would like to see updates on DoW .

thanks in advance.