Of all things technical analysis, I also enjoy pondering the longer term charts. They cannot really be traded on, but they kind of give you this ‘I am the captain of this ship’ type feeling. The other nice thing about them is they help to filter out all the shorter term ‘trading noise’ that exists in the shorter time frames.

I don’t look at the super long time frames that often but I usually do when the calendar changes to a new week, month, quarter or year.

The fact I am talking about on the SP500 in the title of this article is that the current YEARLY OPENING PRICE is exactly equal to the current YEARLY LOW price. I had mentioned this one other time before but it is worth mentioning again because in terms of candlestick analysis it is very important.

I am embarrassed to admit that only until recently have I started using candlestick charts exclusively. I was using regular bar charts for the longest time and never really shook the habit. Perhaps I was just stubborn. But I can tell you with zero doubt that understanding the basics of candlestick analysis, patterns and psychology behind the candles and their structures and patterns will give you a very significant trading advantage over the longer term.

The best book on Japanese Candlesticks (of which I have a copy) is Japanese Candlestick Charting Techniques by Steve Nison. It is really well written and provides a huge amount of charting examples to clearly see candlesticks in action and their expected outcomes.

So back to my point about the opening price of the current year 2010 being exactly equal to the low price for 2010. The actual value for the low and opening is 1116.56 according to my price data (I am assuming that my price data is all correct here otherwise some of the conclusions I make here slightly less meaningful).

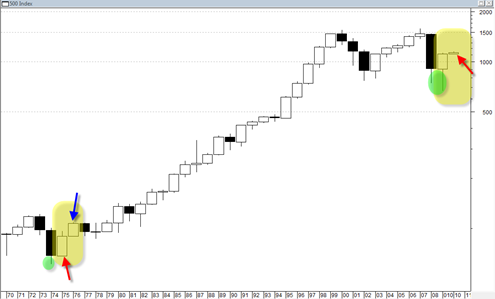

According to my data there was only one other year in the SP500 where the yearly open was exactly equal to the yearly low since 1969. There are pointed out in the chart below with the two red arrows.

I looked through each yearly bar in the SP500 to see where these occurred and it was only in the two yearly bars pointed out in the chart. You might think that we had such yearly bars during the extremely bullish 1995 to 2000 period but in fact there were none during that time frame. Each of those yearly bars had some very slight bottoming tails.

Of course you might point out that the 2010 bar has only just started which is absolutely true and it could very well reverse downward and start creating a much different looking candlestick.

But if the SP500 continues to drift higher without giving any real evidence of supply coming into the market (as it has been doing lately), then this 2010 bar is going to keep looking more and more bullish.

The most bullish type of candlesticks are the ones where you see either very small bottoming tails at the bottoming of the candlestick or no bottoming tails at all. The reason why this is the case is because it shows that the bulls where able to take control of the market or stock right from the get-go without delay and without any supply coming into the market.

So the level of 1116.56 on the SP500 is extremely important to me as a level and reference point for shaping up this 2010 candlestick. To me it is the level where the war of 2010 (in the market 🙂 ) will be won or lost.

It is also worth mentioning once again the 2009 candlestick. It has that unusually large bottoming tail which points out all the demand that came into the market. The whole 2009 candle itself has tendencies to a pretty good looking reversal hammer, hence the positive action so far in 2010.

So at least from this longer term perspective so far I have to remain constructive on this market and keep a bias towards bullish price action.

At this point the only thing that is going to get me more interested in finding short opportunities (on the major indices) is a price move on the SP500 that activates and goes LOWER than 1116.56. If that happens then I am going to become more keen to bearish possibilities.

But if we do not get to that level or lower then I have to assume that the 2010 candle which has already started off quite bullish, will continue to expand higher filling out the candle as it did in the 1975 time frame (red arrow to blue arrow candle).