I have been studying the sp500 structure and the current apparent rising bear flag we have seen form over the past week or two.

As much as I would like to focus 100% on the technical analysis setups in the stock market and individual stocks, the reality is that sometimes there exists important forward looking events that can serve as magnets and help define risk and possible outlook for stocks or the market in general.

Including forward looking events in any analysis probably needs to be done with extreme care because most of the time one never really knows how the market will interpret any forward looking news or if it would even have any effect at all.

But I think it is reasonable to conclude at the current juncture that the Greek Election coming up 12 trading days from now (on a Sunday) is going to be a very important forward looking event for World Market indices.

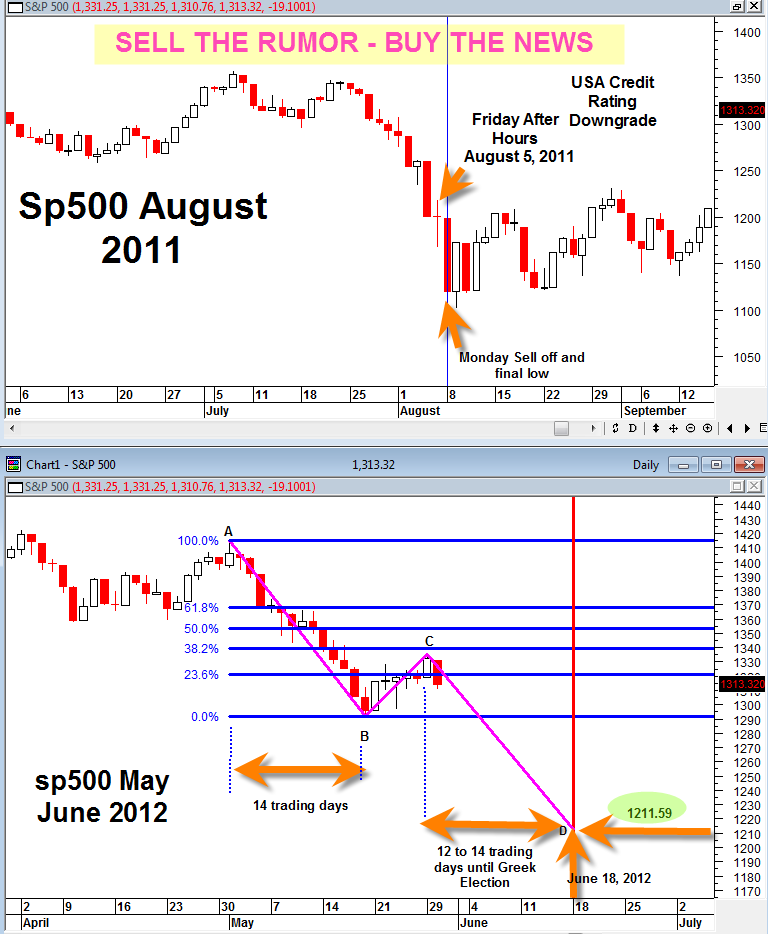

Do you Remember the USA Credit Rating Downgrade ?

The key aspect of the USA credit rating downgrade was the fact that the market dropped right down into that downgrade and bottomed on the downgrade on August 8, 2011. I believe the credit rating downgrade occurred on Friday August 6th either in the afterhours session or after it was closed maybe around 8pm or so.

The market dropped hard right down into that date and saw a final washout the following Monday.

Now we find ourselves in a somewhat similar situation except the forward looking event this time is the pivotal Greece Election on June 17th.

The situation during the USA credit rating downgrade was SELL the rumor and BUY the news. The market knew that news was coming and it sold right down into that date. Upon the news actually arriving there was a final flush and bottom on the news and relief that it was finished.

The present time frame speculatively suggests that the market will once again sell the rumor (the bad news arriving regarding Greek election June 17th) and then BUY the news of the completion of the election.

Interestingly, the June 17th date coincides in nice symmetrical fashion with an AB=CD expansion based on a recently completed 38% upward retracement. The AB=CD projects in symmetrical time fashion relative to the first leg of the down move that has occurred in the sp500 since 5/1/2012.

So based on the projection in the chart above it seems as though 1211.59 is a feasible number in the sp500 by June 18th, 2012, right into the Greek Election. The news on the weekend of the Greek election could be either good or bad, but just the fact that it is over with should provide the market relief and the chance to form a more tangible bottom (probably temporary bottom).

The fact that the sp500 has so far only managed a 38% upward retracement since the mid May 2012 low is potentially very bearish from here on forward as we move into mid June 2012. It suggests to me that the down leg if it resumes could be equally as strong (if not more so) as the first leg down from the start of May 2012.