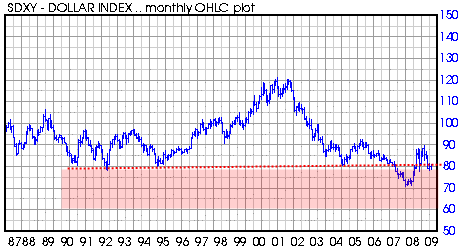

The US dollar index is barely holding onto crucial support at the 79 level. This is a MAJOR story in my opinion and could have dramatic implications for several markets including forex, the broad market and gold.

The clear story with the US dollar in 2008 has been the MEGA bounce that it was able to achieve with the flight to safety trade and liquidation trade that was occurring all through 2008. The US dollar was the ‘least worst’ currency in light of all the worldwide macro problems occurring then. But now, with calmer heads prevailing and the US administration printing money and starting new programs like they will never go out of style, we see the US dollar once again weakening. It has now fallen to the 79 range of support.

The 79 range of support is not a simple support, it is a very significant support that goes all the way back to 1990, clearly a significant length of time for a support level.