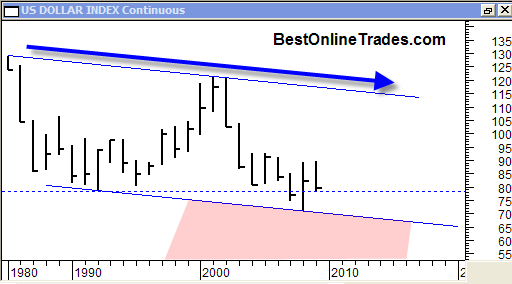

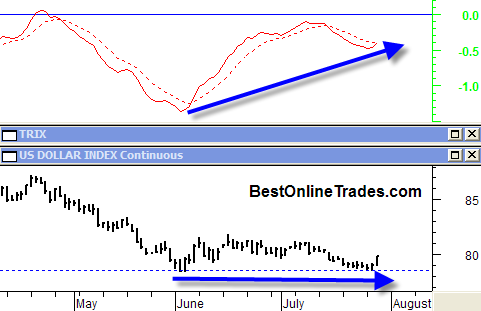

If you have been wondering why gold and the broad market is powering higher take a look at these two charts of the US Dollar Index. The US Dollar Index has broken key levels of support on both the longer term and shorter term price charts.

UUP US Dollar Index May be Forming Small Head and Shoulders Bottom

The US Dollar UUP ETF may be forming a small head and shoulders bottom formation that is almost near completion. At previous points in the chart one could have said the same thing but then the dollar just kept breaking down again and again. The only thing different about this formation now is that the … Read more