A lot of market analysis sometimes boils down to some very simple analysis. But we humans try to make market analysis as sophisticated and complex as possible to make ourselves look smart and feel important.

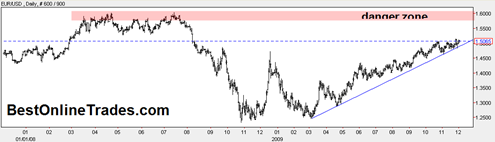

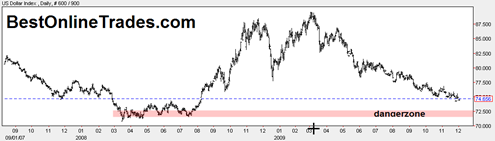

But could it be that the next major trend change or at least consolidation and retracement be due to the two simple charts above? I think it could very well be.

The Euro is trending higher on a solid up trendline and appears to be close to the point of some type of final blow off run into that red zone I labeled in the first chart above. Conversely the US Dollar appears to be headed into that red zone of support, perhaps also in ‘blow down’ fashion. When either the Euro or the US Dollar Index hits those zones I would logically expect some type of big downward bounce in the Euro and upward bounce in the US Dollar Index.

When they get into those ranges I would think the powers that be (central bankers worldwide) would start making a lot of noises that their currencies have gone ‘too far out of line’. So that type of thing could cause some huge bounces and break downs and it will probably coincide with them hitting those red zones above.