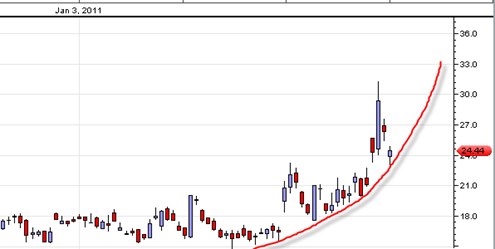

Someone emailed me a chart of the sp500 against the 5 week RSI indicating that it looked very oversold. I decided to investigate and looked over the chart myself. I find myself coming to the same conclusion.

I do not think I have ever focused on the 5 week RSI for timing but it seems to be making a case for a bounce from here on the weekly basis.

Of course 5 week RSI can always get more oversold into ‘extremely oversold’ range. It is a matter of probabilities. But the current 5 week RSI reading is showing that the market is the same oversold condition as was the case only 3 other times going back to early 2008.

If we are going to get more oversold on the 5 week RSI from here then it would start to challenge the oversold level that occurred during October of 2008 which was an extreme record and major outlier.