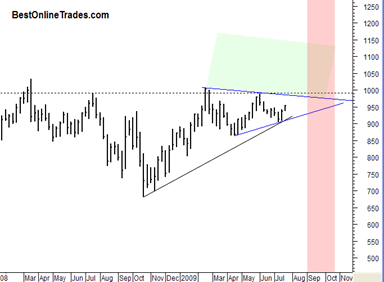

Polymet Mining Corp may be getting ready for some sort of uptrend here pretty soon. If you look at the chart I can conclude a few things already.

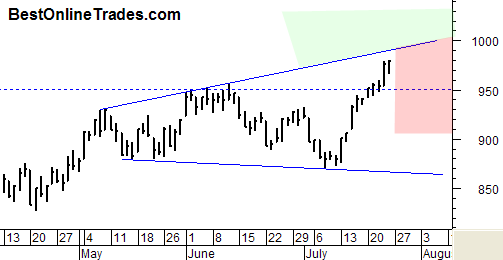

- It has held support on its uptrend line since mid March with 2 tests.

- It has completed a consolidation of about 2 months duration.

- It has broken through the resistance as defined by the white downtrend line.

So I think we might see a trickle of an uptrend on this one. But I have to add that these mining stocks are not for the faint of heart. In my experience they tend to trade with heavy retracements and cumbersome up trends. And it makes sense that they trade that way because they are in the mining industry which in generally requires large equipment and investment costs and slow to market type products, especially when they are in the exploration stage.

Apparently Polymet wants to mine copper, nickel and other precious metals precipitate according to their website. You know, I really wish all mining companies right on their homepage would say in very large text exactly what they are mining for, what their proven and probably reserves are, and when they plan to start production (or if they are producing right now how much). That way it give the entire investment community an quick 1-2-3 idea of what they are dealing with. Perhaps I am a bit lazy to dig through all their information myself but it just makes sense to me to provide that right up front especially for mining companies since it is one of the most important factors in their valuation.