I am only going to do one post today and it is going to be on the GLD ETF because I want to emphasize how important a day it was today in the gold market.

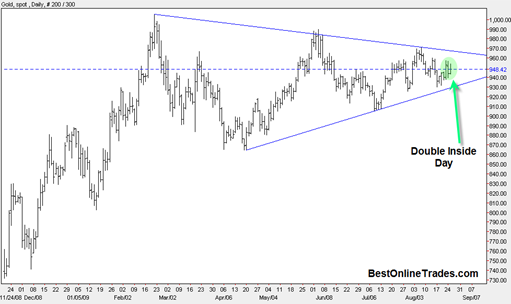

Today we broke out north from the large symmetrical triangle with confirmed volume and confirmed sign of strength. The triangle formation has been developing since February-March 2009 time frame. This is quite a large triangle and has significant cause for an extended move.

But there is even better news. This symmetrical triangle also makes up the right shoulder of the much larger head and shoulders bottom formation that has been in existence since March of 2008.

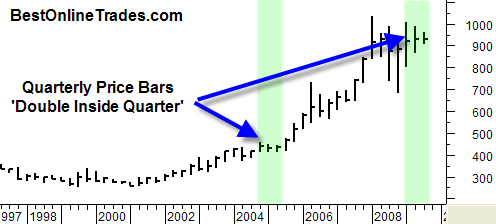

And there is even more better news. The entire head and shoulders bottom formation of approximately 1.5 years in duration is in itself the handle of a super large cup and handle formation which is 30 years long.