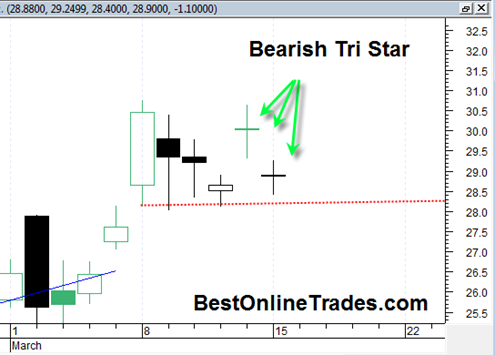

CAGC the absolutely MASSIVE momentum China Stock Play that has been performing like a true champ, today finished forming a potential pattern that should provide a halt to the rocketing share price.

The pattern is the bearish tri star candle stick pattern. The pattern consists of three candlestick doji’s in what looks like a tri star formation and there exists gaps between the top doji and the two bottom ones.

Now I gotta tell you, I would be the last man on this earth to recommend shorting a super strong momo China Stock like CAGC. However in only 1.5 months CAGC has managed to rise 144% which is astounding. That kind of move is unsustainable and in most cases needs some kind of retracement before it can continue higher.