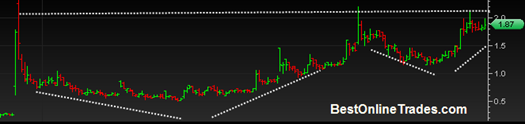

ANDS has had a couple recent big price moves to the upside, and the overall price structure is suggesting to me that ANDS could be setting up for a breakout.

After a brief strong run in the beginning of this year, ANDS went into a somewhat relentless decline to roughly 1.50. It then had a pop up to the 3.00 range on blockbuster volume. That pop was sold off intra day and today’s upside pop was also sold off intra day. However the overall structure of ANDS has some notable and constructive aspects to it.

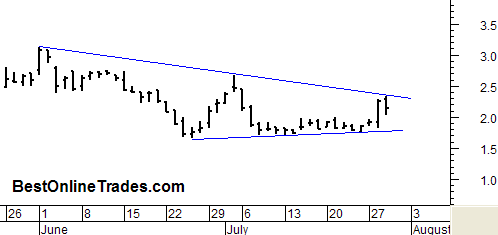

Although somewhat messy looking there appears to be a head and shoulders bottom formation with neckline resistance at 3.14. The left shoulder was around 1st May, the head from mid May to end of July and the right shoulder the last 6 trading days. If I am correct in identifying this head and shoulders bottom, then we could eventually see 4.50 as a target.