Only a small handful of stocks came up on my new scan that I discovered. I got 6 results from over 4500 NYSE and Nasdaq stocks. Unbelievable. I continue to be extremely impressed with this scan because it is returning so few candidates out of so many thousands of stocks. And some of the candidates it returns tend to be at optimal time and price locations. Now part of this is the result of the positive overall structure of the broad market, or is it? I will not really know until I start to see the results of this scan in a more choppy sideways market or bear market.

The stock scanner also tends to reveal a lot of spotty type stocks. With more spotty volume and price. That is because I have it open to give me results on as many stocks as possible. I am not limiting it to stocks that just trade above a million shares a day for example. I do this because I do not want to limit opportunities of what it may find.

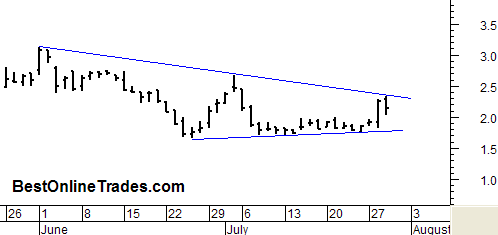

Anyway, AWBC and VOCL came up in the scan. Both of them have somewhat spotty charts and VOCL has quite a small trading float (about 6 million shares) so it’s moves can be fast and sharp in both directions. (click on each chart to see full size)