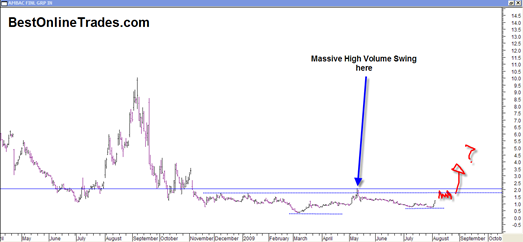

This is an important alert on EPEX. I did a post before on EPEX Edge Petroleum. You can see the previous post under the related posts section down below. It looks to me now that EPEX is coming close to a decision point and I cannot say for sure whether it will be up or down but the probabilities say it is going to be an upside breakout.

There are two significant swings on EPEX that make this analysis worthy. You can see them more clearly if you click on the chart above. They stand out like a sore thumb. But the key point to be made about those two price swings is that the second one had volume that was substantially larger than the first one. That is an important clue about what the future direction of the stock price will be upon a breakout from this pattern.

My analysis shows that the direction will be UP. However we will not really know until it happens… that is just the way these markets work, let them give you the signal and then go with the flow. As of now EPEX is still constrained within this tight range.

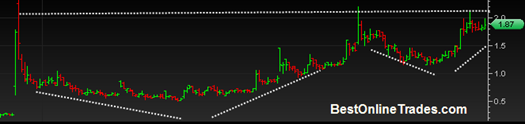

BestOnlineTrades.com has spotted ETRADE corp ETFC as a possible upside trade this coming week, possible as soon as Monday morning (this morning).

BestOnlineTrades.com has spotted ETRADE corp ETFC as a possible upside trade this coming week, possible as soon as Monday morning (this morning).