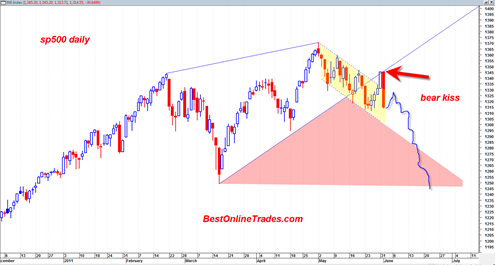

After today’s price action in the sp500, it appears once again that BestOnlineTrades dot com has nailed the low in the market with a good amount of precision.

We do not claim to be perfect here at BestOnlineTrades.com. We do not pick perfect bottoms and perfect tops, but we know how to read the tape and follow the price action and the volume resulting in occasional powerful long or short signals in the sp500. During the last few weeks I have barely followed the economic or fundamental news. I do not watch CNBC or read Bloomberg any more.

I would say that my exposure to business fundamental news stories is almost non existent. I follow the tape 99% and maybe occasionally get 1% exposure to macro fundamental news (sometimes it is just impossible to avoid, ie. driving in the car and hear news summaries between commercial breaks etc.).

In fact, I would say that my lack of exposure to fundamental news stories and lack of interest in them puts BestOnlineTrades at a very key competitive advantage relative to many other market timers and newsletter writers and other traders. Why? Because I am making my decisions based solely on the tape action and the volume. Not just that, but also the interpretation of them minus any news bias.