This last week of upside trading was a total blow out to the upside. It was almost as if ‘they’ had a plan of operation… like a scorched earth type of plan, not giving the other side a chance to get out.

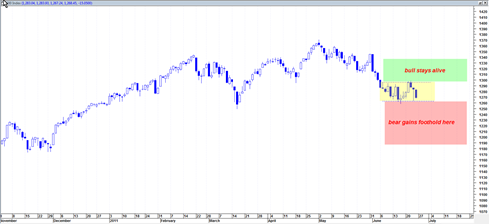

There is a candlestick pattern known as ‘three white soldiers’ which is essentially a bullish signal because you have 3 successive long white bullish candlesticks in a row and it tends to be a sign that a new crowd is taking hold of the tape. But looking at the tape I see not 3 but 5 of them. So I can only assume it is giving the same signal.

Now comes the question whether July 5th will be a down day or not since 5 up days in a row is rare enough as it is.

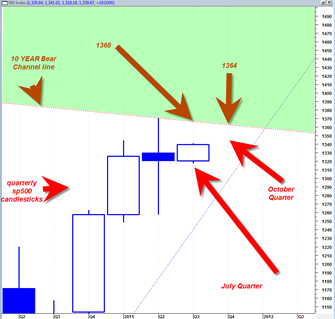

I would say that odds suggest that it will be a down day (or at least some type of consolidation hammer day) because today we hit and stopped right at the previous ‘shoulder’ of the 2/18/2011 high. It looks like a natural resistance point.