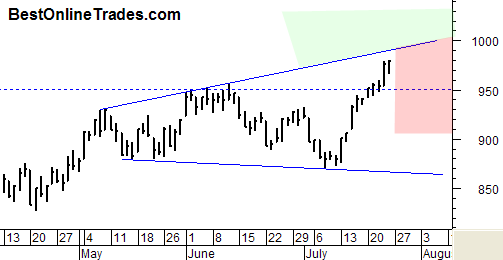

The short term sell signal I was talking about yesterday seems to be a wrong signal. Perhaps I was splitting hairs too much. It is still early, but the market is powering higher in what appears to be a sign of strength over previous resistance that exists in the late May to early June time period.

So I have to respect what the market is saying at least as of right now and am going to change the short term signal to long again. This market wants to move higher and this move may be faster than many expect.

I would like to add either the SPY or the SSO (SP500 double long ETF) to the BestOnlineTrades Recommended list but I would rather wait for the first pullback from this rally before initiating. I hate to chase it after almost 9 days straight up.

It is still going to be interesting to see what kind of volume we get on this breakout today and if price can hold the breakout at the top of the range. So far this looks like a sign of strength early today but we will have to see how things look by end of day.

Anyway, to summarize, the broad market has invalidated my short term sell signal I had yesterday. This market wants to power higher. The nature of this rally should be quite persistent given the modest retracement that occurred from the May to end of June correction.

Read more