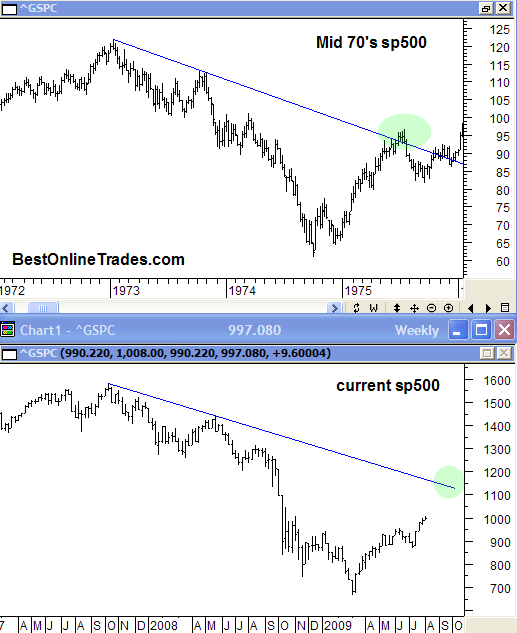

In a word. Thoroughly confused. I can still see the broad market trending higher maybe even for the rest of September. The price action continues to show little interest in breaking down.

What is bothering me is that I started following Larry Pesavento’s forecasts recently and he keeps talking about a big market drop that is supposed to happen soon and happen suddenly and that will eventually break the March lows. It has screwed up my own psychology of the markets because I have been generally bullish and am still seeing enough bullish setups in individual stocks. The market still has not given signs it wants to start a major downward trend change yet. So why try to pick a top? It just seems fruitless at this point.

The monthly SPY price bar so far rejected the lows and now appears to want to expand topside. To be sure, when the REAL correction comes it will come suddenly and a good portion of the damage will happen in a matter of hours. But until that point comes I am still bullish on this market!

The entire rally we have had since the March lows has been on lighter and lighter volume. This is a warning that eventually a nasty correction will start but the problem comes in trying to pick a top. Low volume rallies can seemingly last forever sometimes.

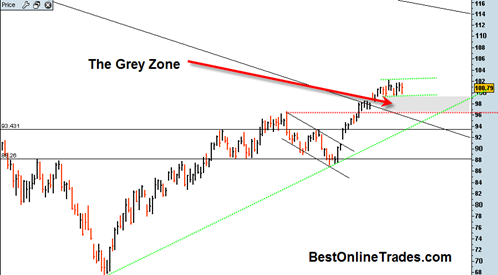

There is a gap on the SPY ETF that would be filled if the SPY hits 107.41. It is possible we are going to go up there and fill that gap in the days ahead and then turn around from there. 107.41 is not that far from where we are today on the SPY.

I am also seeing a possible triple bearish divergence developing on the SPY ETF. It will probably take another week or two to develop but it is worth keeping an eye on.

In the meantime I am still focusing in on ABK because I think ABK at least has the chance of being a blockbuster trade, maybe even better than the gold and silver breakout. I like gold and silver but the problem is those markets can take forever to move. I want to try to find something that moves soon and moves big.

The SP500 looks like it wants to get a retracement going. Currently I am thinking somewhere near the 950 level as I mentioned before being minor support and normal in the sense that often one will see price retrace right back to the breakout area.

The SP500 looks like it wants to get a retracement going. Currently I am thinking somewhere near the 950 level as I mentioned before being minor support and normal in the sense that often one will see price retrace right back to the breakout area.