Today is another interesting day on Wall Street. The Arms index hit a high today of close to 3.65 and tells me that today’s decline is most probably a one day oversold type event. The market was very clearly in heavily overbought territory and very overdue for some type of pullback. And so when any market gets in such a severe overbought level the smallest piece of news can be enough to get a big correction going.

How we close today will still be important as a setup going into next week. If we close near the lows today then it could be a sign that next week will see some downside follow through. On the other hand a decent end of day rally today may set the stage for a bounce next week to work off this oversold situation right now.

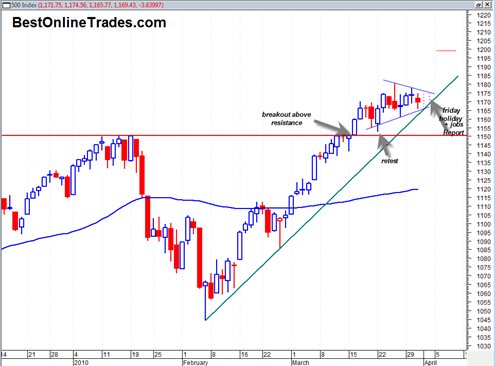

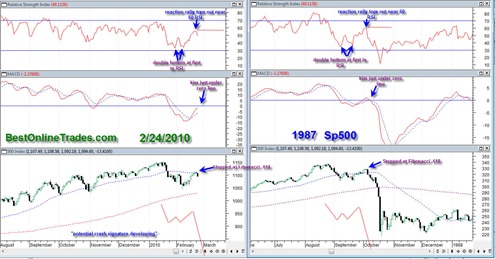

It is possible that this is a more significant top, but we will probably need another attempt at the highs for better confirmation. So far the SP500 is still trading in a higher highs and higher lows type situation and until that changes I give the benefit of the doubt to the bulls.