The bounce in the stock market arrived right on schedule today. It was big and dramatic however the volume did start to dry up today and I suspect it will continue to do so during the next 5 to 10 days as we move from a high volatility state to more moderate volatility state.

I still believe we are setting up for a historic crash that may be so severe it will really cause an unbelievable amount of shock (and fear) to the system and could potentially on its own be a catalyst for a return to economic weakness and skyrocketing unemployment.

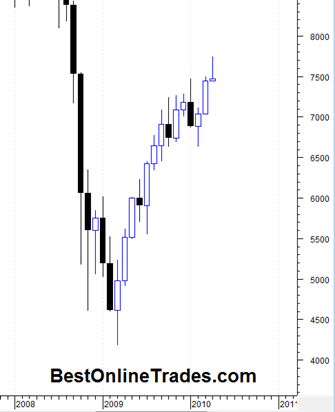

We appear to be entering the most devastating leg of the bear market that began in the year 2000 and from my understanding of Elliott wave this leg down should be relentless and persistent perhaps containing multiple crashes within and almost behaving like a ‘bull market in reverse’.

It is the opinion of BestOnlineTrades that the market should now be traded as if we are going into a new bull market in REVERSE.

There is a larger overall market structure which has been pointed out by the folks at Elliott wave and a few others but I think I will have to devote an entire post to it because its implications are very profound. The technical argument is basically that the entire market is building a very large head and shoulders topping pattern since the year 2000 top. But what is most significant about the pattern is where its measurement rule would eventually send the market. How about zero? Can you believe it? Well its true, the measurement implication of this large head and shoulders pattern, if true would send the market indices to zero or single digits at best. More on that in a future post…