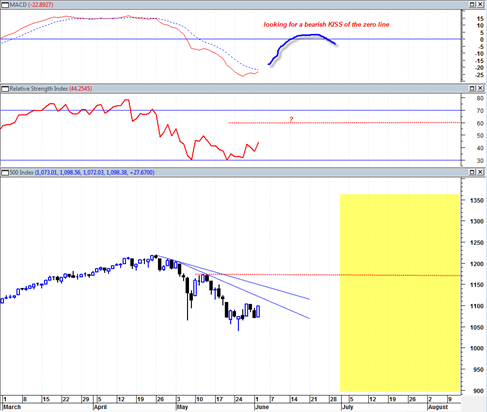

This may be the most significant post I have done in a long time here at BestOnlineTrades. I can smell a big drop coming, I can taste it, see it and feel it in my bones. This is how the trading dynamic is setup up right now. Let’s not forget how the first flash crash on May 6, 2010 started. If you were looking at it real time you could see that it started as a simple calm looking DOJI candlestick but then transformed into a monster in minutes.

This may be what transpires over the next few days. CALM teasing action to tempt the bottom pickers and the technicians into going long because the market is ‘oversold’, but then the bottom falls out seemingly out of nowhere.

Today’s tape action in the market may have provided the final nail in the coffin of evidence that we are about to plunge badly again, possibly in crash type fashion or just continued waterfall fashion with huge swings in both directions but ultimately a lot lower.

Make no mistake about it, I am extremely bearish on the market right now and today’s tape helped to remove any lingering doubts I may have had. I see the market at a juncture right now where it must blast higher by several hundred Dow points, otherwise it will totally collapse. That is how well defined it looks to me right now. It is either or, and nothing in between. If I am wrong here then I will be wrong very badly and we will see this market shoot higher very fast and very wide. If I am wrong, then it may have to do with volume, because the volume was quite light today and makes downside follow through look suspicious. However the low volume is consistent with the symmetrical triangle pattern and descending triangle patterns I have alluded to before. So you can see a surge in volume come out of nowhere from these patterns.