Today’s market action sure felt like we either had a Fed decision or options expiration, but this was not the case at all. It was simply slow sloppy directionless Monday in late June trading.

I think the market today succeeded in keeping most bears and bulls completely clueless about what the next direction will be.

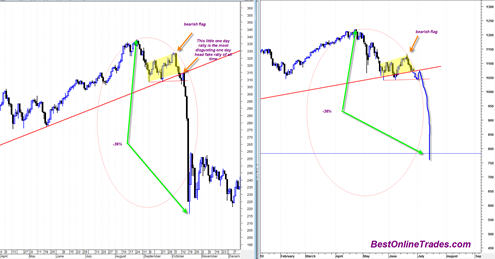

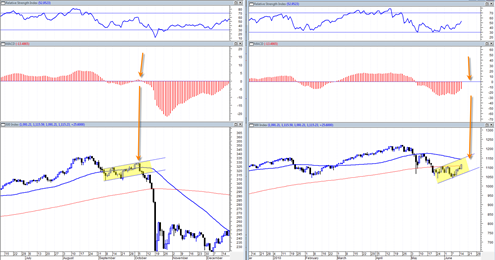

It has seemed as though in recent days that most if not all of the bearish bloggers I follow and other traders have turned neutral to long this market. Or they have closed out shorts and are waiting for 1150 or October 2010 before re shorting this market. My personal take is that neither of the above two will happen. My take is still that this market will collapse in the days and weeks ahead based on my indicators, chart pattern analysis and tape read of this market.

I can come up with plenty of reasons why this market could rally from here from a technical standpoint right now (at the bottom of a swing trading range, relatively low volume decline, oversold readings, full right shoulder not formed yet, poor seasonality for a new decline etc etc.) But I can also come up with a good bunch of reasons why the market could still collapse from here as well.

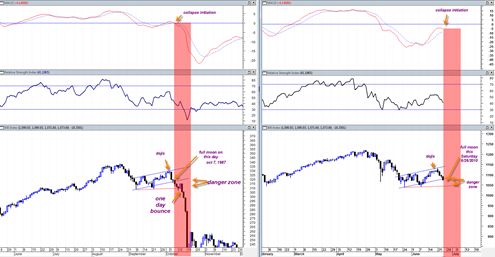

By the way it is nice to see that Bill McLaren on CNBC Friday sees very similar to what I see coming. He mentions about a move to 1040 and then a big one day bounce and then a total collapse after that. Actually I see instead a move down in the market the correlates with 14 day RSI (relative strength index) getting to 30, then a big one or two day bounce from there and then a total collapse. The most concerning aspect of this forecast is the fact that he actually came public with it on CNBC from a contrarian standpoint.