The Arms Index today closed at an amazing number if you are superstitious. It closed at 6.66 according to my data provider. I am not going to go into the superstitious aspects of that number but I will say that on a very short term basis the market is deeply oversold. This was the highest reading since 6/4/2010 record high closing value of the TRIN and before that it was the highest reading since 2/10/2009, quite a long time ago.

The volume on the SPY ETF today was 273 million shares which is a dramatic increase from the last few weeks but still not of the level that I would consider it panic volume. In fact the steady declining volume trend in the SPY since the April 2010 highs still shows this pattern even after today’s mini flash crash.

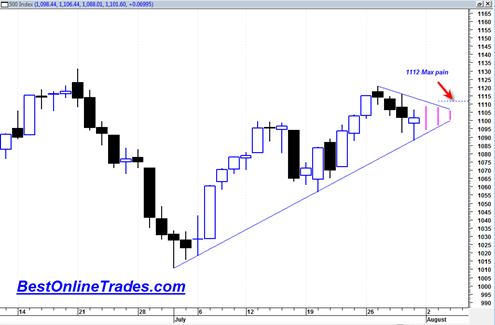

So the very high closing TRIN today tells me we get a one day bounce higher tomorrow to work off some of this short term oversold condition and get back into the range of today’s 20/20 candlestick bar.

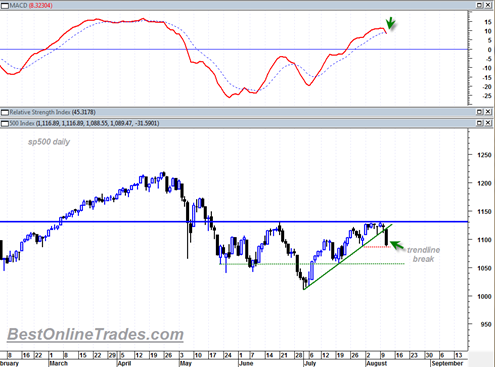

I think it is very telling that today we did not get down below the 7/30/2010 price hammer candlestick low of 1088.01 We had all this price destruction today, the high ARMS index reading wholesale dumping of almost everything and at the end of the day the bears could not even push us down a little bit more to break the 1088.01 swing ? (red dotted horizontal line) Hmmmm. It bolsters my short term take that we bounce higher tomorrow within this somewhat larger rectangle.