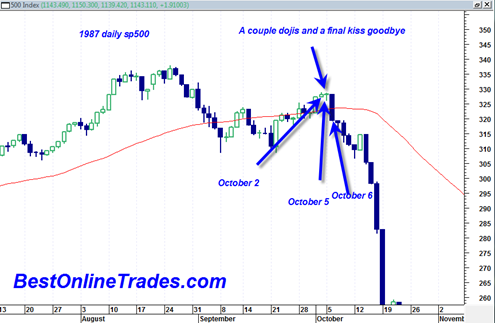

The sp500 today traded reluctantly down after hitting its ‘head’ on the top long term bear market resistance trend line. Today’s price action was at first in the form of a small narrow range doji. It was also initially completely within the range of last Friday’s price candlestick. So the setup at the beginning of the day was a ‘double inside day’ which can sometimes lead to big moves.

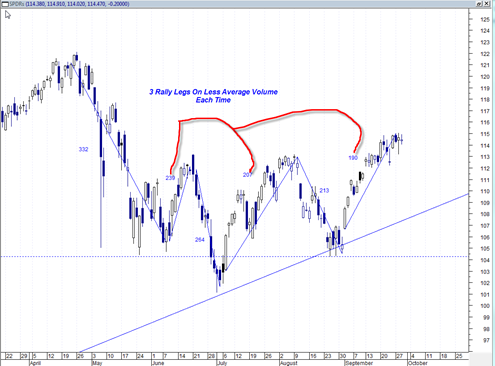

We got a down move and closed modestly down in terms of price and volume. Volume on the SPY was unusually weak and is a bit of a concerning sign as far as the bear case is concerned.

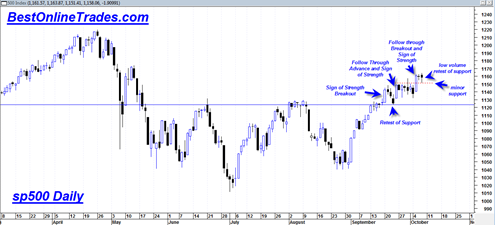

I really want to see a confirmed sign of weakness in price and volume that leaves zero doubt that the uptrend since early September is broken. It is actually already broken if a trend line is drawn from the 1st of September up to recent highs, but it is not really broken with conviction yet.

The closing ARMS reading today at least on a 1 day basis was nothing unusual or extreme and maybe shows that there is almost zero fear in the market right now.

The Volatility Index continues to be squeezed slightly above a large falling wedge pattern. It would seem that the VIX is about to launch higher in a big way, but it is still trying to get some running legs. Sometimes northward moves out of falling wedges can very fast and abrupt right back to the top of the wedge. This would seem to suggest that a sharp and abrupt move DOWN is within sight on the sp500.

The McClellan summation index on the NYSE ticked down today and may be starting to finally roll over. It looks a bit like the summation index has double topped.