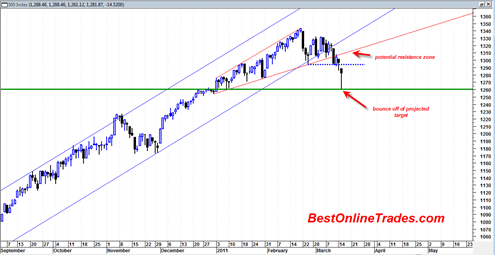

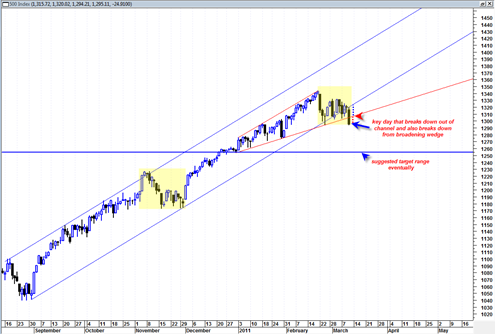

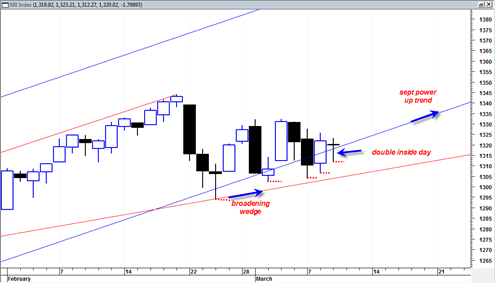

It looks like there is a strong probability we have created the first tradeable low in the sp500 today on this panic of the Japan earthquake and nuclear situation. I wrote in a previous post that the sp500 was forming an important broadening wedge formation and that the ideal target for the drop is the 1260 to 1270 range which would be the beginning formation of the broadening wedge. As it turns out this is almost exactly what happened.

Today had the flavor of a panic high emotion low with very heavy volume.

The ARMS index today hit an intra day high of close to 12 which is an astounding amount of intra day fear and helps argue the case that we are near an important trading low. I believe that is only the second time in history that the ARMS hit such a high level.

My understanding of the rising broadening wedge formation is that it does not necessarily have to be a major top, it can simply also be a corrective formation within an uptrend. This is important because I still think it good to keep an open mind about the nature of the current correction.