Today the powershares QQQ Trust, symbol (QQQQ) tested the gap from yesterday on about 25% less volume. It has become clear to me at this point that any decline we get from here is going to be labored and lacking in conviction.

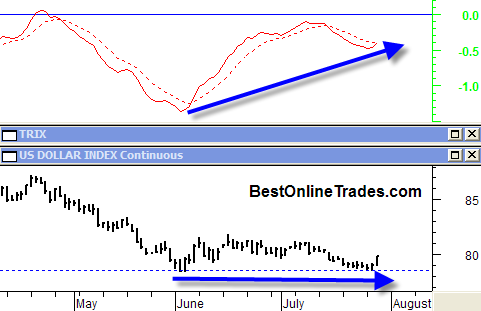

I still think 37.20 is fair game for a target on the QQQ Trust in August, but there are a few reasons why this may be delayed short term. One of the reasons is the US Dollar index, which broke down badly today. I am going to write a post on the US Dollar in a moment. A declining US dollar is supporting higher prices in the broad market.

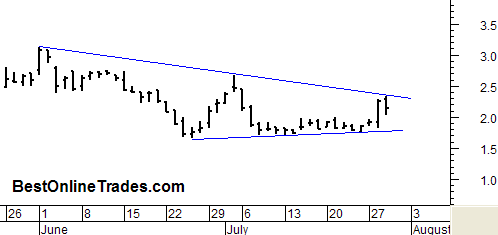

I should also mention that major topside resistance on the QQQ Trust comes in near the 42 and change level. That level represents the primary bear market trend that began way back in October of 2007. It is in my opinion a very significant level and one that we will be watching closely going forward. At the current rate the QQQ is travelling, we might just get there within a month or two.

It seems almost a foregone conclusion that this level will be tested. The nature of the test on the weekly charts is going to be very important to watch. If we see price bump its head on that down trend and have a fast reaction down, it could be a warning sign that the down trending resistance line will hold and not be broken.

On the other hand if we see price hug the bottom of that resistance line for say a month or two, then it could be a bullish sign and we might see a massive upside breakout through that bear market force.