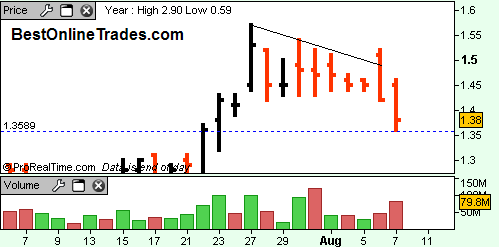

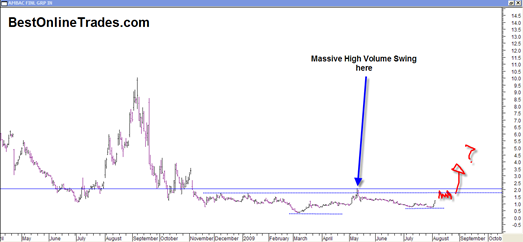

Etrade Financial looks like it wants to come alive again. If ETFC can get a move going above 1.52 and above that short term white down trendline I think we may see ETFC make a run for the 2.00 range later on this month. I have been going back and forth on ETFC. I indicated in my previous article that ETFC was not worthy of consideration anymore because it broke out of pattern on heavy volume and that the setup if any was confusing.

But if you look at the mini chart above you can see that ETFC has clearly held support of the 1.34 area, and that level of support is pretty solid. So we bounce off that level today and are making a slow motion run back to the top of the range. But ETFC still needs to overcome the shorter term resistance and get a move going above 1.52 for me to become even more encouraged.

If ETFC was to enter a more bearish scenario then ‘they’ should have been able to take 1.34 out readily the last few days, but ‘they’ didn’t … So now we are back topside again and maybe a new setup is developing here.

I have no clue how ETFC will close today and whether the FOMC news today will either ruin or enhance the run today. A lot of times when I have seen the market up big ahead of the FOMC it seems like it has usually been a case of buy the rumor and then sell the news. So I would not be at all surprised to the the broad market only up a couple points by end of day.

But let’s see how well ETFC can hold up today.

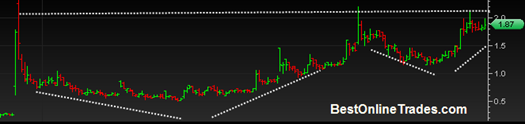

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.