The FAZ Triple Inverse Financial Bear ETF looks extremely attractive to me right now based on everything I am seeing in the market. The UNG performed as expected and is now getting to be a tired trade already and I suspect it will pull back some before building higher down the road.

But now the FAZ has flashed all sorts of buy setups and looks very good to me going into next week and end of year and early January. I think we could see FAZ blast higher into the high 20’s range during the next 1 month time frame.

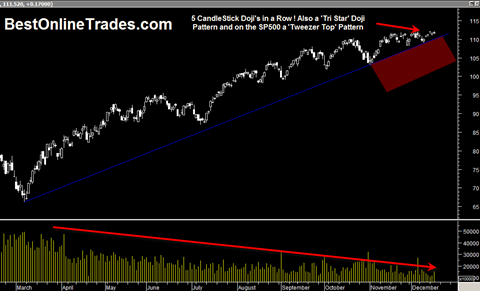

As I indicated in a previous post, the WEEKLY MACD has now turned down on the SPY and the SP500 index. That means that the market will have weekly bearish headwinds going into next week.