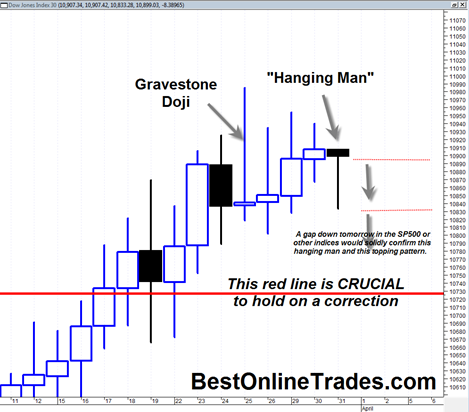

I think today is simply a mid point type move of the first leg of this correction. It just does not feel like the bottom yet. If we had a high volume reversal hammer today then I might say that we are ready for a nice big bounce topside.

Instead we got an indecision doji candlestick which was also on almost the same volume as yesterday. That tells me that the market is simply digesting the recent minor support area and while it may go sideways or slightly up for a day or two, I expect soon thereafter another big body blow to the downside to create a mini exhaustion type move.

After reviewing my charts I can clearly see that 1140 on the Sp500 should be the start of a violent bounce to the upside. I am hoping we print that level either tomorrow or Friday as a means to close out shorts. I have not decided yet whether it will be worth it to play the upside bounce but for now these are the guideposts I am looking at.

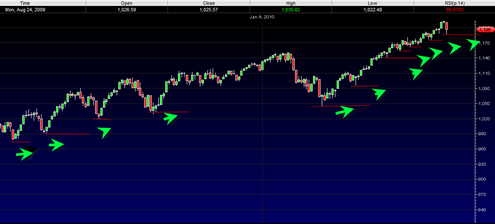

Assuming I am correct that we get a good bounce going from 1140 then I would expect the peak of the next reaction rally to serve as a pivot point to trade back down to the bottom side of the ascending broadening wedge (the solid red lines in the chart below).