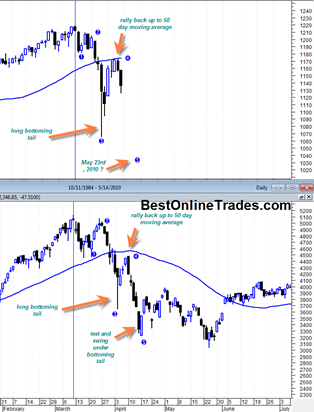

The SPDR S&P 500 ETF today accomplished a bullish spring of the May 6, 2010 mini crash swing low during the last 2 hours of trading today. A bullish spring is when volume is not sufficiently heavy enough relative to previous swings and closing price is above those previous swings.

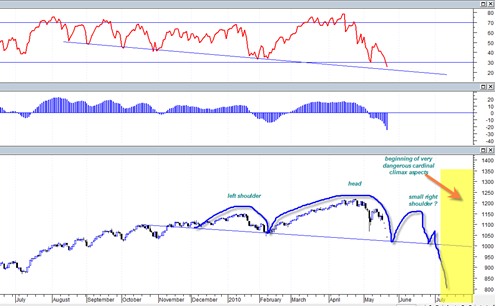

It was a close call today because the way the market was set up (including macd histogram, RSI and some other indicators) it really needed to get a good reversal going again otherwise it would have put the market at risk of a very severe plunge below May 6, 2010 support. It just goes to show how the market is capable of putting everything on the line with only a few hours left to finally give the reversal signal. The action today had the flavor of capitulation and leaves me much more confident that a true reversal is at hand. How high the bounce is remains an open question however.

Also helping the bounce case is the US Dollar Index. It looks like it double topped today on the daily chart and should get some type of move back down to its own 50 day moving average. Perhaps that will support equities for the next 5 to 10 trading days.