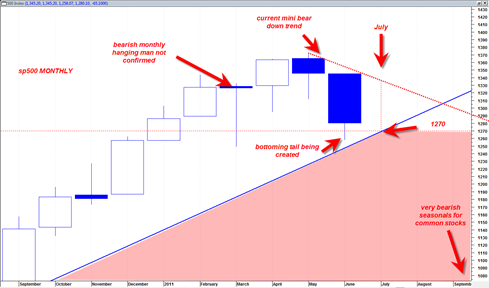

The low in the sp500 for June so far was 1258. Today we had a nice sized rally. With just 3 trading days left in the month of June the market now has the option to create a larger June monthly bottoming tail which shows demand, or continue down the last 3 trading days of June and perhaps even more so into the start of July.

Presently it is looking like the market wants to create more of a bottoming tail for June that could see the market rally into early July.

In the chart below this would create a June monthly candlestick with a longer demand tail and then create greater probability that we could see a rally as high as 1330 which is the top boundary of the current ‘mini bear’.

Assuming that actually does happen, then we could see 1330 hold as bear market resistance leading to a flat to slightly down August 2011 and then maybe a much more meaningful drop in the typically very bearish seasonally September.