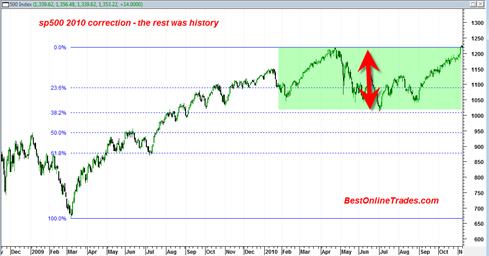

There is a somewhat untold sp500 story that I would like to talk about in this post. It has to do with the recent correction we appear to have recently completed relative to the price advance that began on 9/3/2010.

We hit two significant price swing lows in recent months on the sp500. One of them was the March 16, 2011 low of 1249.05 and then there was a follow on higher low of 1258.07 on June 16, 2011. Both of these swing lows were within the 38.2% Fibonacci retracement zone (pretty close to it) relative to the advance from 9/3/2010.

So once again we see that the sp500 was not able to do more than a 38.2% retracement of the entire mega rally that began on 9/3/2010. This is an important fact and points once again to the internal strength and momentum strength of the sp500.