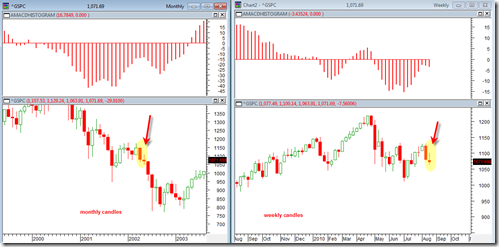

The sp500 today once again briefly pierced the lower Bollinger Band and the Bollinger bands themselves have continued to expand wider. This is an indication that we are entering early stages of a volatility expansion which is in contrast to the volatility contraction that occurred during the last several months. The movement higher in the VIX volatility index today is confirming this fact as it broke out today from its large falling wedge formation.

I really have not used Bollinger Bands that much in my analysis but I might start to use them a lot more because they can be a very useful tool for trend direction signals. They are most useful to me when I see the Bollinger bands move from a state of low volatility (a contraction) to expanding volatility. The expansion of the bands often signals the start of a new more volatile move. The piercing of price under either the higher or lower band can be an indication that price now wants to trend or hug closely that particular Bollinger band line.

Sometimes price moves so fast that it can trade almost completely outside one of the lower or upper Bollinger Bands. This is very rare and is usually a point where the market has climaxed and ready to trade sideways again.