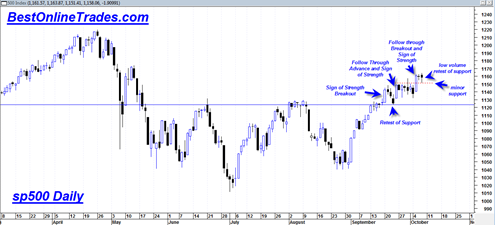

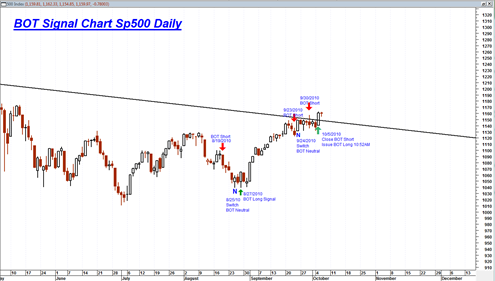

Today the sp500 hit an intra day low of 1155.71. This was once again a move into the supporting range of 1150. The sp500 once again today rejected this range and closed higher, signaling more upside to come. It appears as though the sp500 will be able to jump over 1170 which should imply an eventual test of the April 2010 highs. Today was the 6th consecutive close above the 2007 3 year bear market channel resistance line.

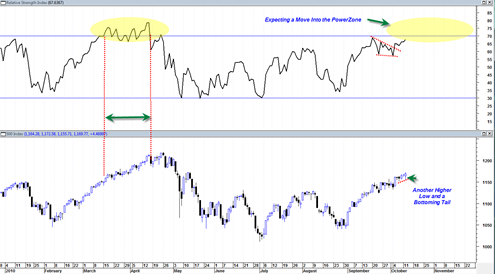

I am currently speculating that the sp500 will move into the RSI power zone above the 70 range at some point in October. It is also possible that we could remain in the powerzone for a period of time somewhat similar to the behavior of the sp500 during the mid March to mid April 2010 time frame. During that time frame (yellow highlight) the sp500 ‘trickled higher’ in a slow cumbersome fashion creating a series of higher highs and higher lows for one full trading month.

BestOnlineTrades currently believes this could happen again and it may once again last a full trading month or longer. It depicts a potential scenario where one sees new shorts entering the market (top picking) and then having to repeatedly cover shorts after the market trends slowly sideways and then starts trickling up again. Obviously this is not a profitable endeavor. Shorting a market too early can indeed be quite costly. And currently my longer term charts are suggesting that an extended bearish trend in the market may be quite a while away into the future.