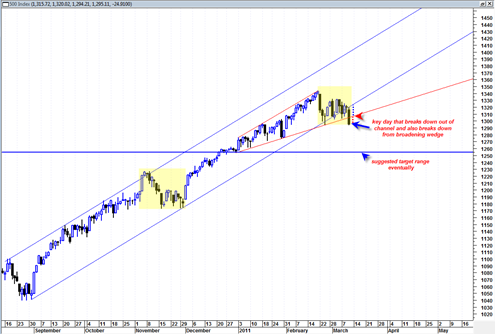

Today was a clear confirmation to me that we have switched from the massive bullish trend since late August 2010 to a beginning bearish trend. In yesterday’s post I pointed out the double inside day 3 day price pattern in the sp500 and said it would lead to a huge move either up or down. Today it was clearly down, closed at the lows and also had more than enough volume to go with it.

I think we could get some type of upward bounce tomorrow on some positive consumer confidence numbers but then maybe a sell off near the close.

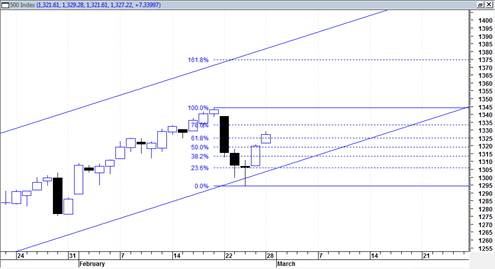

A bounce higher tomorrow could reach two possible levels. One level corresponds with the underside of the broadening wedge formation I have been talking about now for quite some time. The other level corresponds to the underside of the up channel we just broke down through.

My preferred choice is that we bounce to the underside of the broadening wedge and then get stuck there for a while and then fail at the end of day.

The much more painful upside bounce level would be back to the underside of the channel we just broke down through. The reason why it would be more painful is because it would completely erase all of today’s short selling gains.

So again the preferred scenario is for an upward retracement to the point indicated by the red arrow in the chart of the sp500 above. I would look for any rally to run into a brick wall near those levels and gauge the market carefully from there.