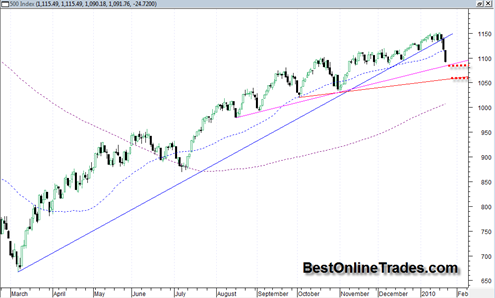

I am more confident than I have ever been in recent months that today’s action in the markets (SP500, DJIA, Nasdaq etc. ) marks the beginning of a much longer consolidation/correction phase than we have seen since March of 2009.

I am still long the TZA and plan to stay that way as a core short position for at least the next 3 to 4 weeks. I have a game plan and will tell you about it shortly because I still feel as though I have somewhat of a ‘cheat sheet’ on this market.

Anyway, here is a brief summary in bullet form the reasons why I believe a long corrective phase is at hand that should see the market decline between 10 to 15% from the recent highs…

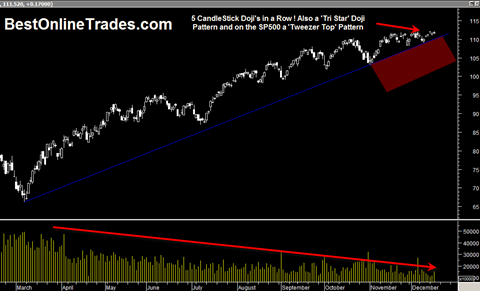

- The SP500 has broken decisively the very long bull market up trendline that has been in force since March of 2009. This was the high angle up trendline that has defined this bull trend and it was broken very decisively with a wide price spread and very high volume especially in comparison to volume levels of the last month or two advancing rally.

- The WEEKLY MACD has finally confirmed a bearish downside crossover today which means that now the price trend should transfer to a “3 steps down 2 steps up” type action. I have mentioned the weekly MACD many other times in previous posts and each time it looked like it was going to do a bearish cross, it them reversed and stretched itself out and evaded the sell signal. But this time it failed to evade the sell in a big way especially when you consider the heavy volume and wide price spread to go along with it.

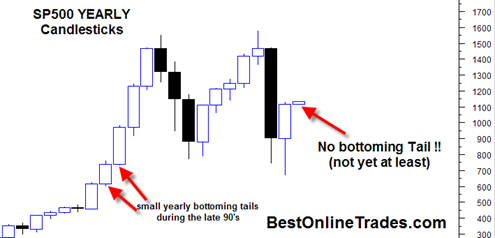

- The Monthly January 2010 candlestick bar on almost all major indices has now transformed into a very bearish looking reversal hammer ( which implies that February will likely see the majority of the most devastating downward price action).

- The YEARLY 2010 candlestick has now transformed into similarly very bearish looking gravestone doji. The yearly 2010 candle now very clearly to me is saying the market wants to do some price retrace down into the 2009 candle.

Those are the main points that give me confidence on this trend change. Now onto the charts…